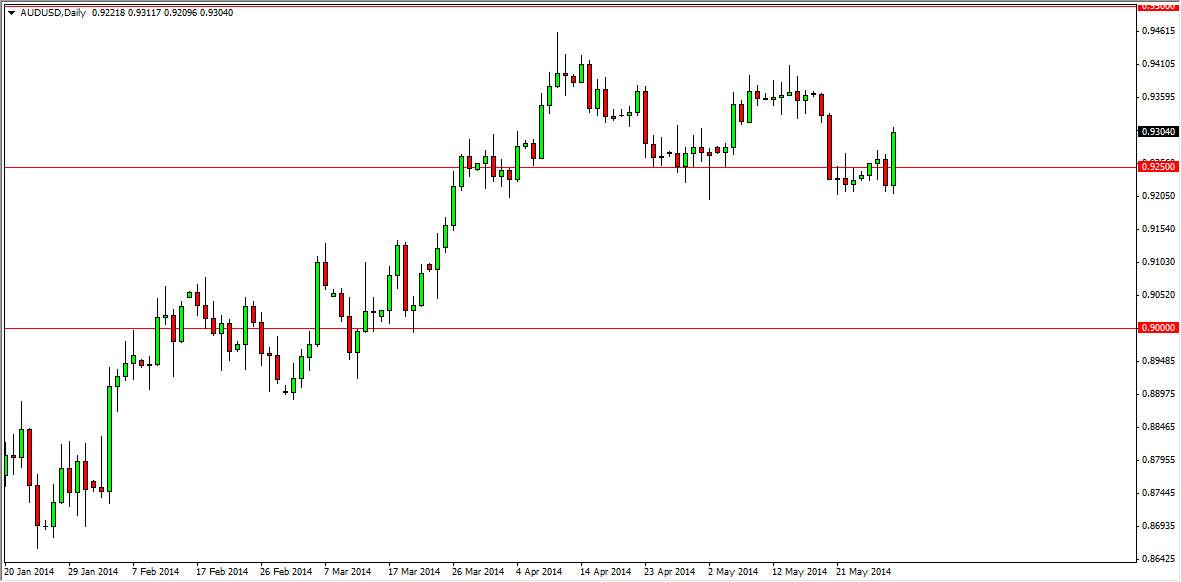

The AUD/USD pair had a very strong session on Thursday, finding quite a bit of buying pressure at the 0.92 level, an area that I have mentioned as being supportive. Since we ended up finishing the day with a bullish engulfing candle, I have to say that I’m very impressed with the Australian dollar, and now suspect that the buyers will come in hand over fist given enough time. I think that initially we will start heading towards the top of the recent consolidation area, but that move in and of itself means that we should go to the 0.94 handle given enough time. I think that we will also break above there though, and head to the 0.95 level eventually as we continue the uptrend that we’ve seen for some time.

Going forward, I think the 0.95 level will continue to offer significant resistance but pullbacks from there should just simply be momentum building exercises as we eventually breakout to the upside. This market is obviously bullish, and the gold market is starting represent some value now, so it’s very likely that the gold market could push the Australian dollar higher.

Continued bullishness.

Would in this market, the fact that we broke above the 0.93 level suggests to me that the market is going to show continued bullishness going forward. On top of that, I think that ultimately the market will breakout above the 0.95 handle, which will more than likely be along the lines of a goal breakout as well. After all, gold has sold off so much that one has to think that sooner or later the value investors will certainly the market higher.

On top of that, the interest rate differential still favors the Australian dollar, and that of course becomes a sort of a thesis for currency traders if there’s any sense of stability, which of course we have at the moment. Because of this, I believe that a break above the highs from the Thursday session is a buy signal, and although it could be a bit choppy, I believe ultimately we go much higher.