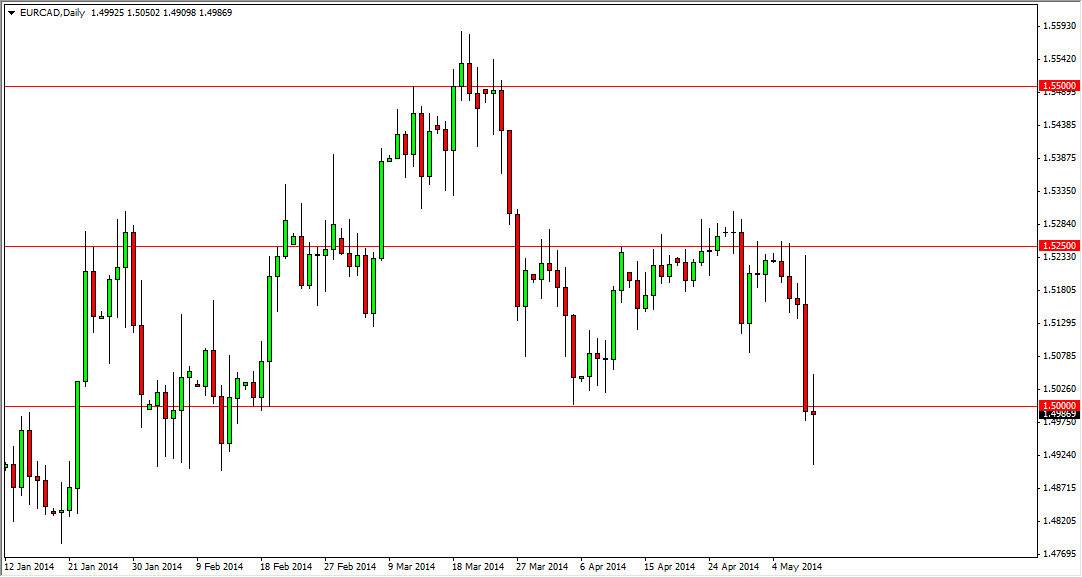

The EUR/CAD pair went back and forth during the session on Friday, hovering around the 1.50 level. This is obviously a major psychologically significant number, so really doesn’t surprise me that buyers and sellers both stood up and took notice during the session. On top of that, the Euro is sitting on support just about everywhere in the markets, and as a result it would make sense that the Euro is somewhat afloat at the moment. However, I see potential for a significant break down if we can break below the lows of the session on Friday, which is essentially the 1.49 level.

On the other hand, we could break to the upside, and that to me would be bullish. I believe that the market would try to hit the 1.5250 level, which is the next major resistance area. With that, I feel that the market is probably a short-term buy more than a short-term sell, because I think there is a bounce coming in the Euro in general.

Remember, the Canadian dollar is a North American currency.

The ironic thing is that this market tends to act very much like the EUR/USD pair, I think mainly because it focuses on the flow of currency from one side of the Atlantic to the other. In other words, it’s a lot of the same pressure in the market that drives the EUR/USD pair. Because of that, I feel that this market should move incongruence with the EUR/USD pair. In other words, if you see a breakout or break down in that market, that could foreshadow what’s happening in this market.

On top of that, pay attention to the oil markets. While the USD/CAD pair has pretty much broken the correlation between oil and the Canadian dollar, the main reason for that in my opinion is that the Americans now produce their own oil. On the other hand, Europe produces very little. Because of that, I feel that this market may be the new way to play the oil markets by proxy using the currency markets.