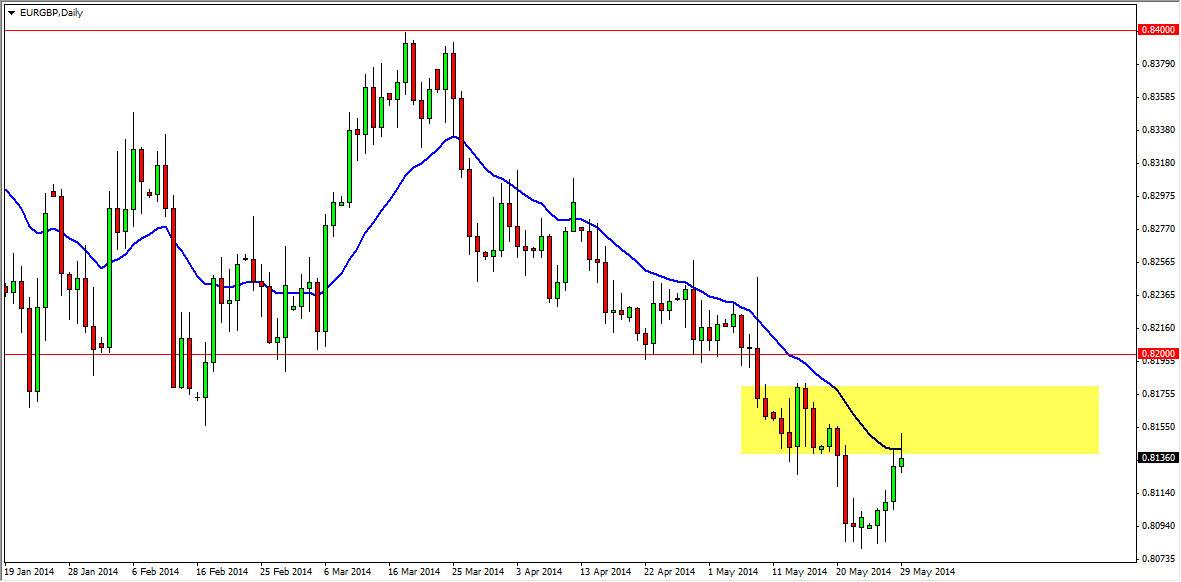

The EUR/GBP pair struggled to hang onto the gains that it found the on Thursday, as the 0.8150 level offered far too much in the way of resistance. That resistance ended up pushing the market back down and forming a shooting star, which of course is one of the more bearish candlesticks that you can find. With that, I am actually very bearish of this market as you can see the 20 day moving average has been very resistive as well based upon the action of the last two months or so. When you have something like that, a cluster at the 0.8150 level as well, and the shooting star, as are several reasons to think that a break down below the bottom of the shooting star should again the next leg down.

The most important thing of course is the fact that we are in a downtrend, and that is by far what can tells me to sell this market the most. I don’t know that this is necessarily going to be a function of the Euro melting down, or if it’s going to be a function of the British pound gaining strength again. Truthfully, I would suspect that is the latter of the two, but at the end of the day it doesn’t really matter.

Continued bearishness, with a major figure below.

As far as I can tell, the target will more than likely be the 0.80 handle. When you look at the long-term charts in this marketplace, you begin to notice that 0.80 is essentially “fair value” in this marketplace. Historically, it seems to be where prices want to end out. With that, I’m not one to argue and I recognize that the recent trend certainly works in my favor as well. So I am a seller, I simply see no reason to buy, and even if we broke above the top of the shooting star from the Thursday session, which I normally use as a very bullish sign, I see that there’s far too much resistance at the 0.82 handle to be comfortable with a long position. Ultimately, I think we will see the 0.80 level tested.