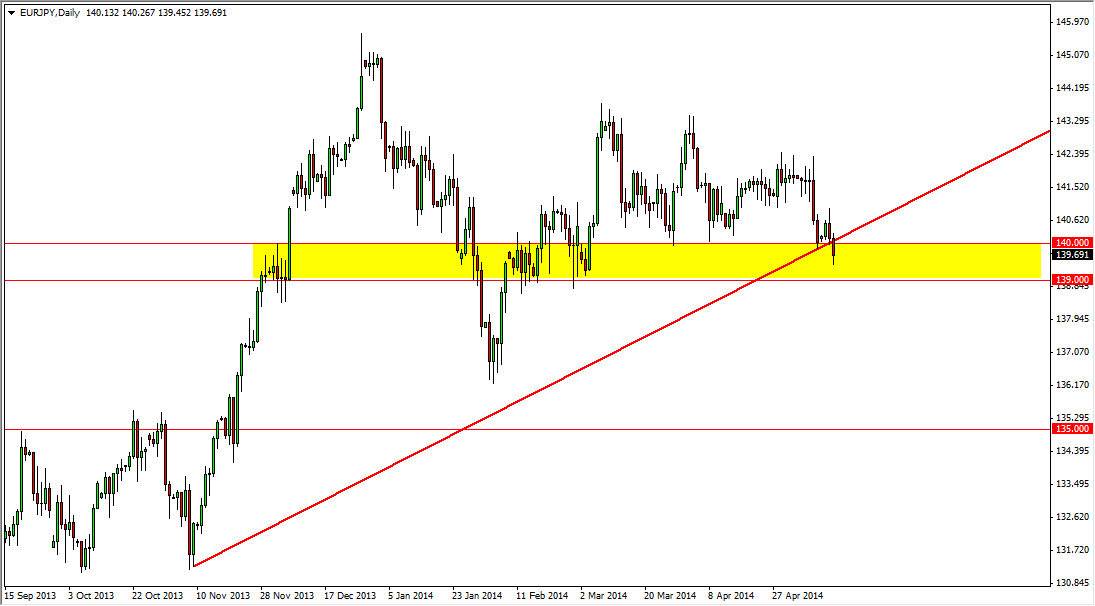

The EUR/JPY pair fell during the bulk of the session on Wednesday, breaking below would could be considered a reasonably decent trend line. With that, this of course is a bearish sign, but I also have suspicions that this market has quite a bit of support all the way down to the 139 handle. With that, I need to see a break down below that level in order to start selling, which is especially true considering that the EUR/USD pair sitting around support as well. Both of the EUR related pairs look very week, but at the end of the day they are sitting at areas where buyers can come back into play.

Going forward, if we managed to get a daily close above the 140 level, I think this market would in fact continue the consolidation that we had seen before, going as high as 142, if not 142.50 or so. That would be a continuation will we’ve seen for some time now, and as a result I would feel very comfortable in that position.

However, there are certain problems with the Euro at the moment.

The Euro looks relatively vulnerable at the moment, and if one of these markets break down, my suspicion is that the Euro will get beaten up all across the board. Forex markets tend to move like that, as traders tend to “gang up” on weakness. That would be the norm, and as a result I feel that a break down represented by a close on the daily chart below the 139 level would bring a lot of sellers into the marketplace in general. If that happens, I can see this market falling to the 136 handle without too many issues as there seems to be nothing but “air” between here and there.

On the other hand, I believe that the more “natural” position of the market would be to go to the upside, but as we are at a serious point of inflection, it certainly shouldn’t be guesstimated before the position present itself. Anybody who reacts now is probably going to be unpleasantly surprised.