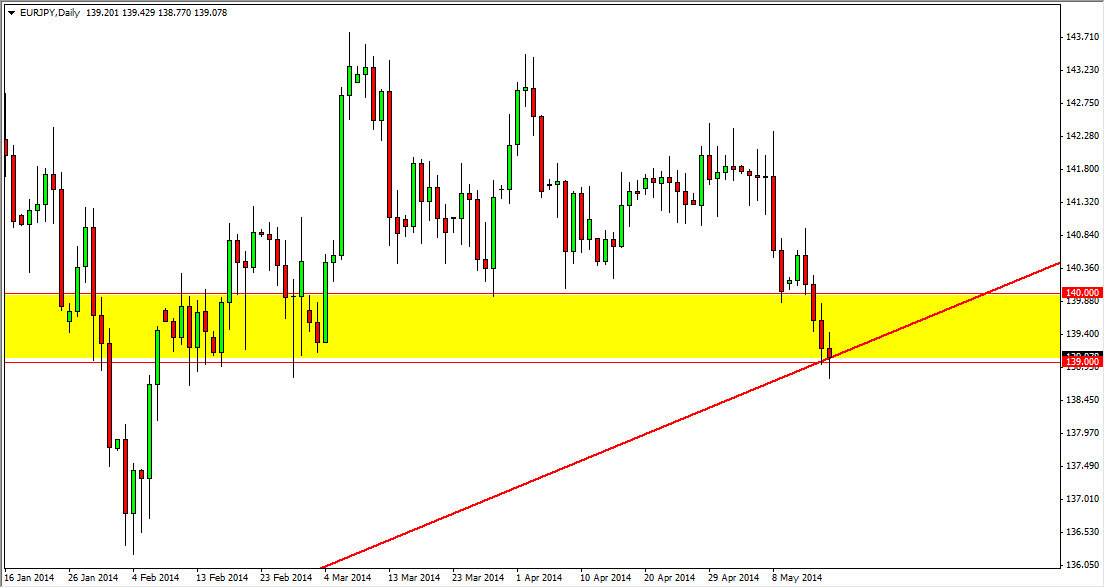

The EUR/JPY pair had a relatively volatile session on Friday, testing an uptrend line that I have been watching for some time now. However, it appears that it held, just as the 139 support level held. On the chart, you can see that I have a yellow rectangle coloring in the 139 level II 140 level, and I believe this is a big support zone that should continue to play a major part in this market going forward. If we can break the top of the candle from the Friday session, I feel that this market will continue to go higher, but we will more than likely have a very bumpy road ahead of us. At the end of the day though, it is not until the Europeans actually cut rates that I would be convinced that this pair should continue to go lower.

However, trade the charts not your thoughts.

This is one of those situations that I will have to trade the chart, and not my thoughts. After all, if we break down below the lows on Friday, I would expect this pair to go all the way down to the 136 handle without too many issues. It doesn’t matter what I think, it only matters with a pair does. This is a perfect example of that potential move. I happen to think that the death of the Euro is a bit premature, but at the end of the day the markets going to do what it’s going to do.

On a move higher though, I think we could very easily go to the 142 level, but it won’t necessarily be a straight shot. You will have to be willing to hang onto a trade through pretty significant volatility in my opinion, but at the end of the day, if we can hold this relatively major uptrend line, there’s no reason to think that the trade will work out for you given enough time.