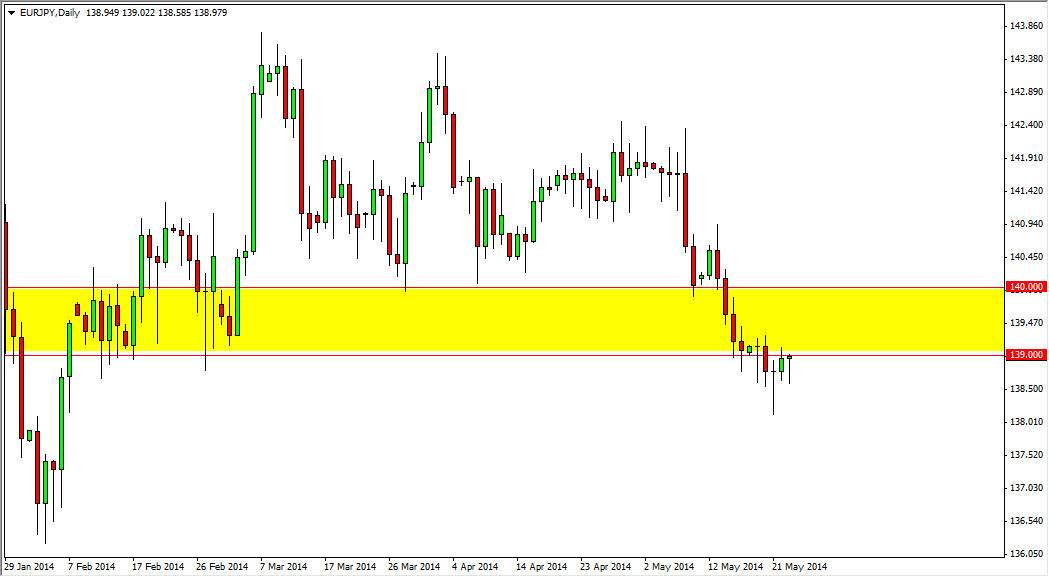

The EUR/JPY pair tried to fall on Friday, but as you can see has found quite a bit of support near the 138.50 level, an area that’s actually little bit lower than anticipated the market testing and still showing somewhat supportive action. Nonetheless, I think that the fact that the market has formed several different hammers in this general vicinity simply shows just how much the market does not want to give up the uptrend.

On a break above the top of the hammer, I think that the market will initially go to the 140 level, and then on a move above the 140.50 level, we should see even more bullish movement as we head to the 143 level. Pullbacks between here and there would be nice buying opportunities, as more and more people reenter what was once a very strong move higher.

It’s about the Japanese yen more than anything else.

For me, I believe that this market is going to be more about the Japanese yen than anything else, as the Euro certainly has its own problems. However, I believe that the Bank of Japan will continue to work actively against the Yen, and as a result we will eventually see the Yen weaken overall, and as a result this pair should continue to go higher, just as most Yen related pairs have. I am actually short of the Japanese yen against several different currencies at the moment, although the Euro is not one of them. This is only because the Euro has at its own problems, but at the end of the day I think that the downside of the Euro is somewhat limited.

Going forward, keep in mind that this is somewhat of a “risk on/risk off” market, but at the end of the day we need to pay attention to not only the Euro, but also the world stock markets has they are the best indicator as to what the EUR/JPY pair will do in general. With that, looking at the other world markets, I think that we are about to go higher.