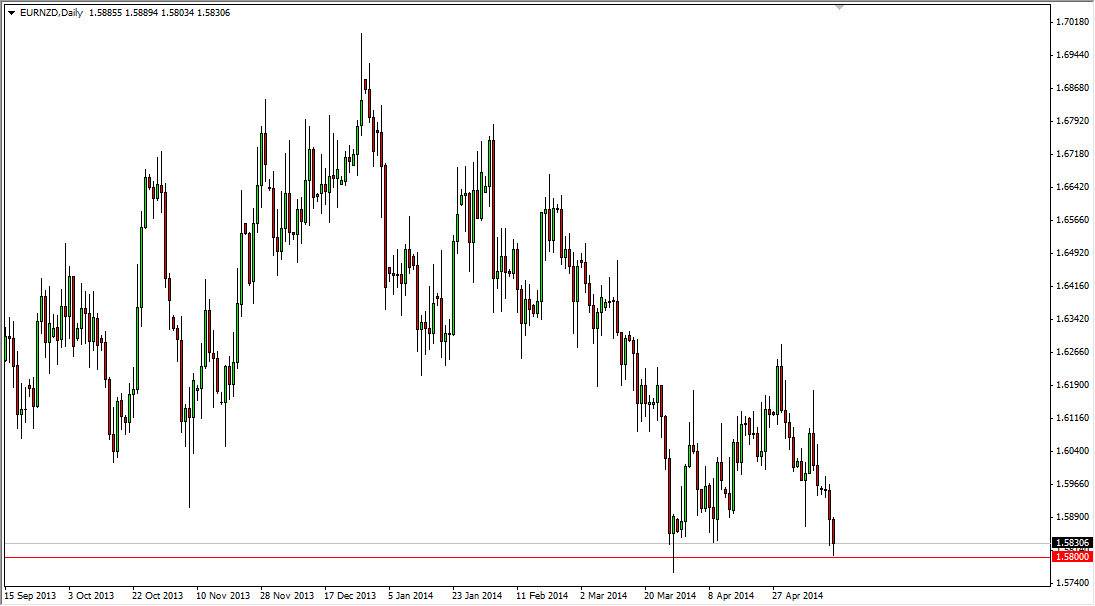

The EUR/NZD pair has been in a nice downtrend for some time now. Quite frankly, the 1.58 level has been a bit port of, but we are now closing with a fresh, new closing low. Because of this, I believe that the 1.58 level will be overcome by the sellers, and a daily close below that level should be a nice selling opportunity. Remember, the Euro has been beat up quite drastically, while the New Zealand dollar has in fact done fairly well, even against the US dollar. With that being the case, it’s quite likely that this market will continue to fall, and we should head to the 1.55 level which of course is the next psychologically significant round number.

Even if we bounce from here, I think that it’s very difficult for this pair to get above the 1.60 handle, and most certainly the 1.62 handle. Both of those should offer plenty of resistance, and any bounce from here should be sold in my humble opinion. I would not hesitate to start selling on a resistive candle, as I believe the market would then try to build up enough momentum to finally break down through what has been very stubborn support.

Pay attention to the commodity markets as well.

Remember that the New Zealand dollar is highly correlated to the overall performance of commodity markets, and risk appetite. If the commodity markets do fairly well, I don’t see any reason whatsoever why this pair once break down. This will be especially true if agricultural commodities do well. On top of that, the Euro has its own problems in if we break down in the EUR/USD pair, it’s very likely that this pair will follow suit. Although the USD and the NZD typically don’t track each other, in this particular case this is about Euro weakness, and has very little to do with the New Zealand dollar itself. However, the aforementioned possibilities could come into play and move the Kiwi dollar in its normal correlations to risk appetite and commodities.