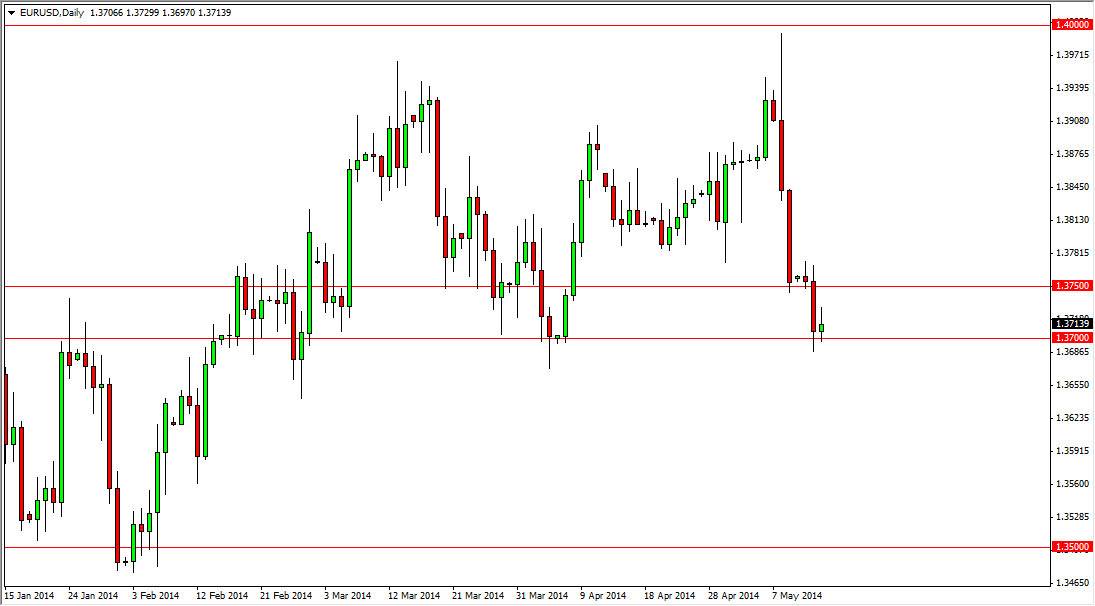

The EUR/USD pair tried to rally initially during the session on Wednesday, but as you can see we couldn’t even get back to the 1.3750 level in what was a relatively tight trading range. With that, I feel that the market has an inherent weakness to it, but I also recognize that there is a real opportunity to see support come into the marketplace of the 1.37 level. I believe that the 1.37 level is very important, as it opens the door way down to the 1.35 level if we break down from here. Ultimately, any move in this pair is going to be choppy as per usual, which is why I a very rarely trade it.

That being said however, I do look at this pair as one that could be trying to form some type of summer range. We could be bouncing around between the 1.37 level on the bottom, and the 1.40 level on the top. Or, we could also be looking at the 1.35 level on the bottom and the 1.40 level on the top, which of course would be a 500 pips range, but that isn’t necessarily out of the norm.

This summer could be interesting.

Most of the selloff in this pair has been based upon comments coming of the European Central Bank, and the fact that they weren’t completely ruling out doing some type of monetary intervention during the month of June. That would be a bit off, as most of the time Europeans do almost nothing during the summer when it comes in the financial markets. Quite typically, the liquidity thins out quite a bit as many traders are at the beaches, and not at their desks. That being the case, we could get a very interesting summer where we could have market moving headlines, which in the lower liquidity environment of the summer market could really throw things around. With that, I’m essentially going to be very careful but I believe that we are certainly at some type of inflection point or at least the short term.