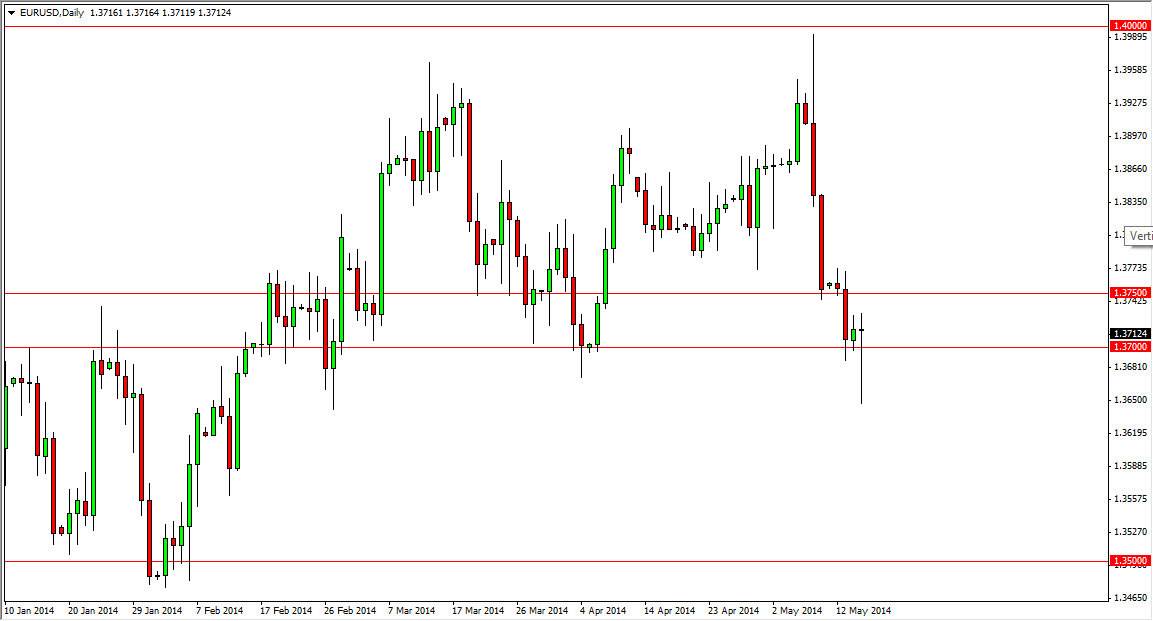

The EUR/USD pair initially fell during the course of the session on Thursday, breaking below the significantly support at 1.37 handle. With that, it should be a sign that the market was going to come undone. However, by the end of the day we formed a hammer that of course suggests that there is a possibility that the market is going to continue going higher. A break of the top of the hammer is and quite enough though, as the 1.3750 level needs to be taken out to the upside in order to go higher. With that being the case, I feel that this market may very well consolidate between the 1.37 level and the 1.40 level.

On the other hand, if we break down below the bottom of the hammer, this could send the market looking for the 1.35 handle, which of course is the next giving in support level. That move would be choppy as well, just simply because we have plenty of support levels between here and there. However, most of them are minor in scope, and therefore will more than likely get broken down below.

Summer months coming, could form a range.

With the summer months coming, I believe that we may possibly find some type of range to trade in. The question then becomes whether or not it is between the 1.37 level and the 1.40 level, or if it’s between the 1.35 level and the 1.40 level. Either one is possible as far as I can tell, but in the meantime if you break above the 1.3750 level, that is the trade the makes the most sense to me as it should continue to be a consolidated and choppy market. This pair has been choppy over the last several years, and as a result I don’t think that that’s going to change during the summer when most traders will be away from their desk, at least the ones with any serious amount of money. With that, I am simply waiting to see what the markets about to do