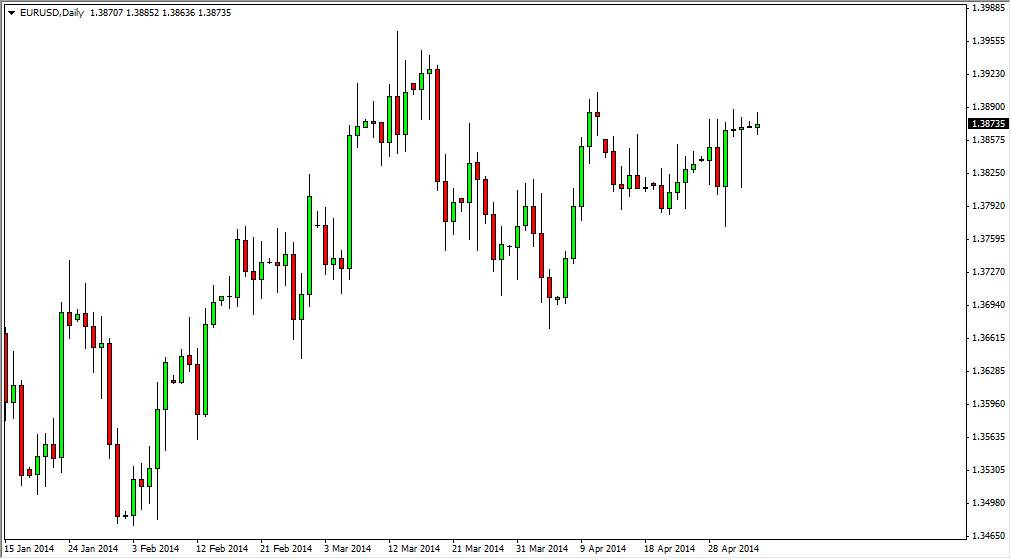

The EUR/USD pair did very little during the session on Monday, as we continue to hover just below the 1.39 handle. Is there that we should see a significant amount of resistance, and we also believe that this market will have a bit of a “line in the sand” if you will at the 1.40 handle as defined buying the European Central Bank. Keep in mind that the ECB is going to do and interest rate announcement this week, and that will keep the Euro quiet in the meantime.

On top of that, this pair has been very range bound for some time now, and with that it is fairly difficult to trade. I see quite a bit of support below though, and as a result it is difficult to sell this market. I see that support all the way down to the 1.38 handle, an area that should have a significant amount of buying pressure just below it as you can see based upon the hammer from the Friday session, as well as the massive green candle from the Wednesday session of last week.

I can’t be bothered.

To be honest, the EUR/USD pair used to be one of the “easier” pairs to trade. However, with the advent of High Frequency Trading, this market has been very difficult to deal with over the last couple of years. Ultimately, we are approaching a downtrend line from the longer-term monthly charts that started back during the financial crisis several years ago. If we break above 1.40, that would in fact send the Euro skyrocketing in my opinion. I don’t expect to see this however.

Ultimately, this pair probably fall from here but we need to see some type of ECB intervention in order to do so. With this being the case, I am essentially staying out of this market and can’t be bothered with trading this type of choppiness. It’s a difficult environment to make money and, regardless of how tight the spread might be at your broker. Quite frankly, if I wish to trade the Euro, is going to be against the Japanese yen.