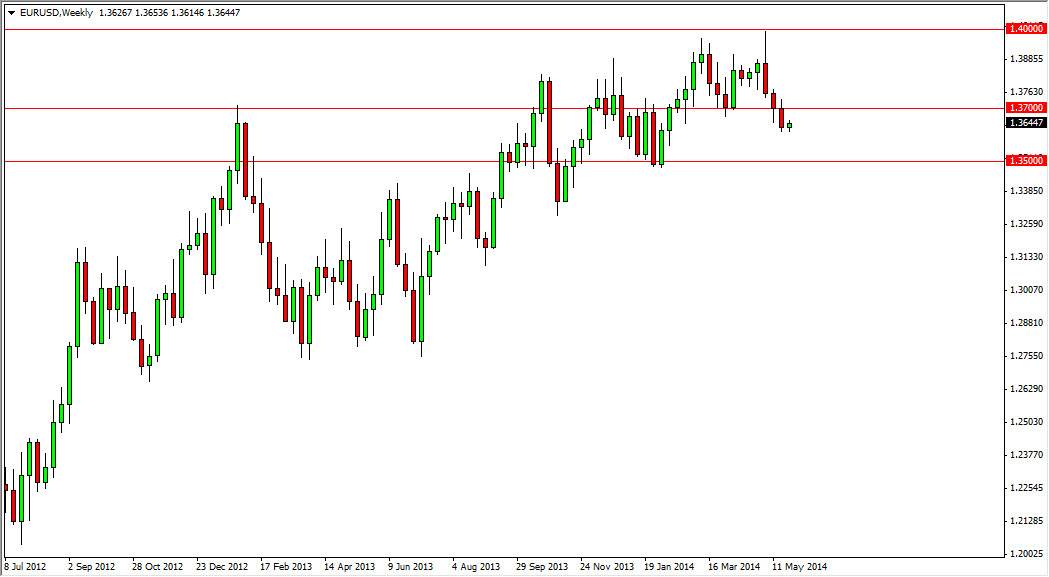

The EUR/USD pair has been falling slightly over the last several weeks, but I think that we will more than likely see some range bound activity of the course of the month of June. Clearly marked upon the weekly chart is the fact that the 1.35 level is supportive, and quite frankly I do not believe that we get below that area. I think that sooner or later we will see support come back into this marketplace, and then at that point time the only real question will be as to what the actual size of the consolidation range will be. Going forward, I would anticipate the 1.40 level to be the absolute “ceiling” in this pair, but keep in mind that there is an important European Central Bank meeting coming this month, which could determine the near-term direction of this market.

It really comes down to what the Europeans do, if they underwhelm as far as monetary policy loosening is concerned, then you can see the 1.40 level broken. However, I believe that we are going to grind sideways overall as it is summertime, and the markets will lose liquidity.

Continued volatility, albeit in slow-motion.

I believe that this market will have continued volatility, although obviously will be in slow-motion as it has been for some time. The fact that we are heading into the summer will probably only exacerbate that, meaning that the markets will continue to be very difficult to trade from the long-term. However, I see the 1.35 level as one that would be an excellent place to start buying. On the other hand, we could get back above the 1.370 level, and at that point time I would be a buyers well as it would show a real push higher.

Ultimately, I do not expect the 1.35 level to be broken to the downside as mentioned above, but if it does happen I would anticipate bad things for the Euro. Ultimately though, I anticipate very sideways in an interesting action over the course of the next several weeks.