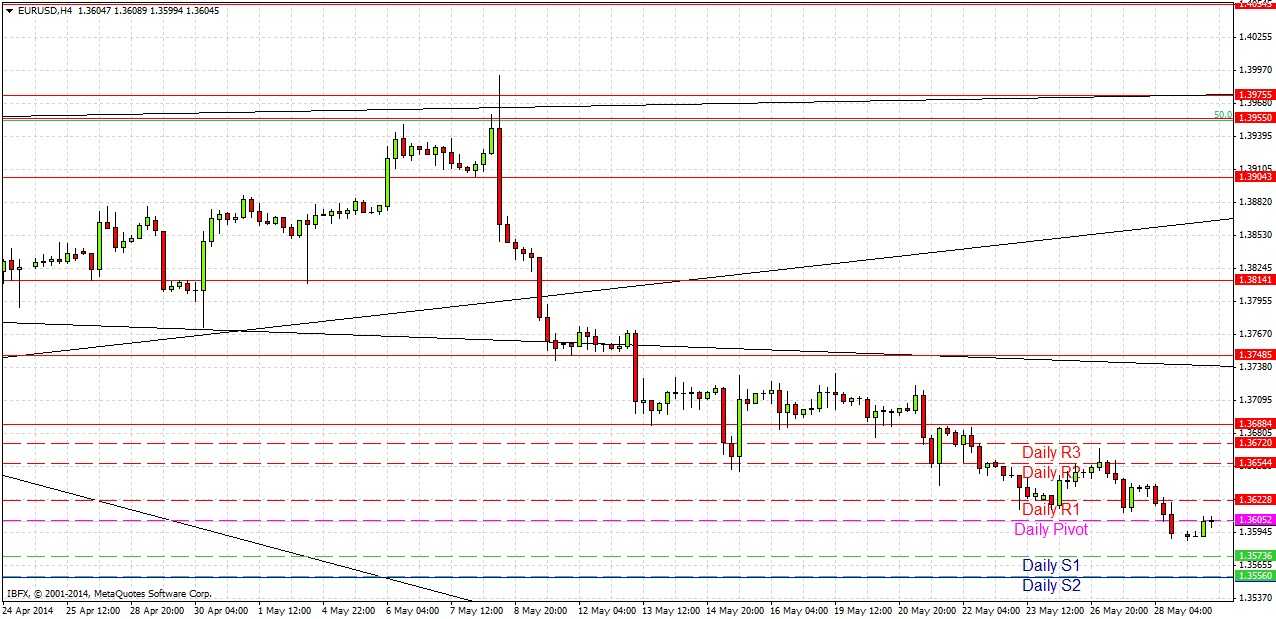

EUR/USD Signal Update

Yesterday’s signals expired without being triggered as the price never reached either 1.3555 or 1.3688.

Today’s EUR/USD Signals

Risk 0.75%

Entries may be made only between 8am and 5pm London time today.

Long Trade 1

Go long after bullish price action following the first touch of 1.3555.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 1.3587.

Remove 75% of the position as profit at 1.3587 and leave the remainder of the position to ride.

Short Trade 1

Go short after bearish price action on the H1 time frame following a first touch of 1.3688.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 1.3655.

Remove 50% of the position as profit at 1.3655 and leave the remainder of the position to run.

EUR/USD Analysis

The price fell again yesterday to reach its lowest point since February, breaking through the support that had held during the past few days at around 1.3610 and paving the way for a likely continuation down to 1.3555.

There is not much more to say except that the EUR along with the CHF has been the weakest currency of this month and although the rate of fall has slowed it is still going down.

My bias is bearish. Today’s action in this pair is likely to take place during the early New York session when there are several high-impact USD data releases.

Key levels to watch are 1.3555 for a bullish bounce and 1.3688 which we are very unlikely to hit today.

There are no important news releases scheduled today for the EUR. Concerning the USD, there are Preliminary GDP and Unemployment Claims at 1:30pm London time. Later at 3pm there will be a release of Pending Homes Sales data.