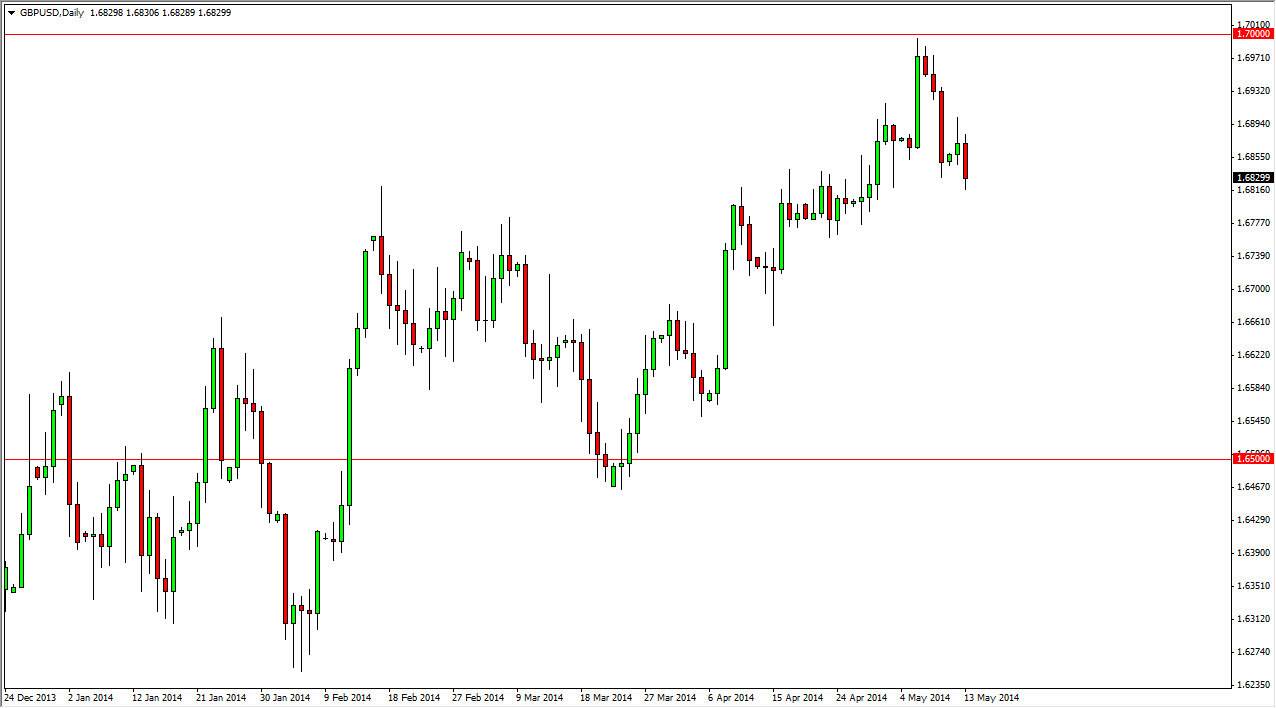

The cable pair fell during the session on Tuesday, testing the 1.68 level. This area has been resistance in the past, so now I suspect that the market should offer support. The 1.68 level was rather significant in the past, and as a result I suspect that there will be plenty of orders there in order to push the market higher again. Also, we are in a longer-term uptrend, and the 1.70 level was the target to begin with. There’s no reason to think that we won’t attack that area again, but as you can see this area will more than likely try to keep the market down. We will need to build momentum in order to breakout above there, which I do expect to see happen sooner or later.

In this area, I feel that the market should find plenty of buying pressure which should eventually turned back momentum of the market and send is higher. Even if we broke down from here, I suspect that the 1.65 level should offer support as well, and that should essentially be the “floor” in this market.

Buy on the dips going forward.

I believe that this is one of those markets that you continue to buy over and over again. I believe that there is plenty of buying pressure below, and that this market will continue to show positive momentum every time we fall as there are so many noisy areas below.

I believe that the farther this market falls, at least as long as we stay above the 1.65 handle, the more interested I become in buying this market on supportive candles. Short-term charts could be used, as long as you pay attention to the longer-term support and resistance areas. Obviously, the 1.65 level is massive support, but I also see support at the 1.68 level, and the 1.67 level. There are plenty of buying areas as far as I can tell, and none to sell unless we get well below the 1.65 level, which would be massively negative at this point in time as we’ve seen such a significant move higher.