By: DailyForex.com

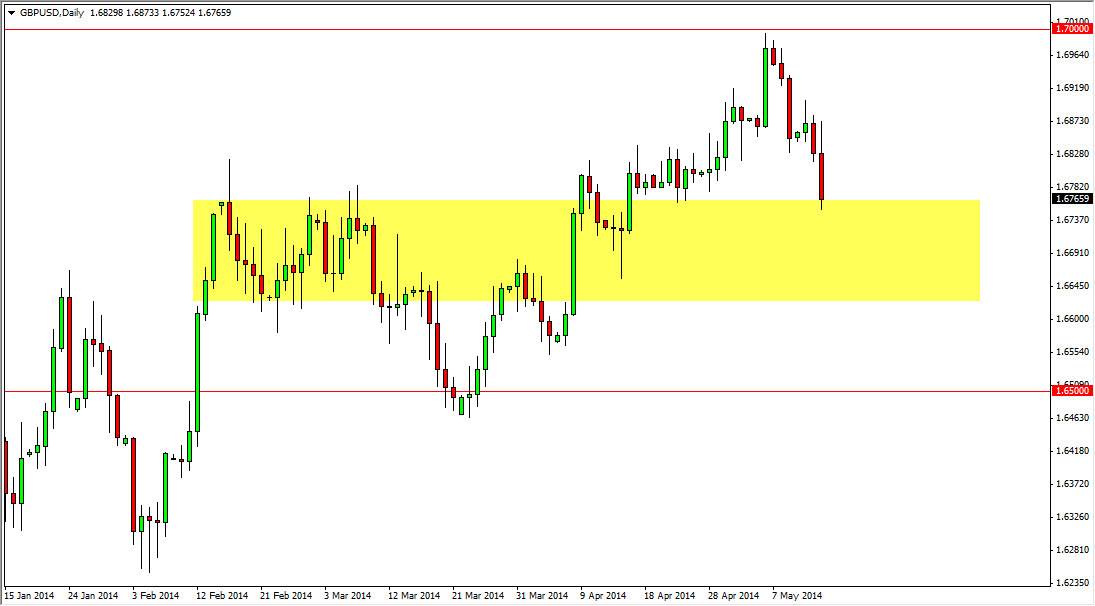

The GBP/USD pair initially tried to rally during the session on Wednesday, but as you can see ran into enough resistance in order to push the market back down. The fall from there ended up turning the markets around and testing the 1.6750 handle, an area where significant support comes into play. With that, we are going to get to see whether or not the British pound will continue to appreciate in value, as this is an area where we should see some type of movement. On a supportive candle, I am more than willing to start buying this pair again, as it has been so strong. In fact, that’s essentially what I’m expecting to see, but at this moment in time don’t have the “go ahead signal” to start buying.

Longer-term uptrend.

There is a longer-term uptrend that we’ve been in for some time now, and we are starting get close to an uptrend line. With that, we could get a little bit from here, but then find plenty of support around the 1.67 level as buyers go into take advantage of “value.” Going forward, I anticipate that the British pound will continue to outperform the US dollar, but there will be pullbacks from time to time naturally. Those pullbacks should be buying opportunities in my estimation, and as a result I am more than willing to buy each one as they appear. Quite frankly, I think that there is a “floor” in this market at the 1.65 handle, and until we break below there, I am not interested in selling this market and also recognize that the support at that area could go as deep as the 1.63 handle. With that, I just have a one way attitude in this market.

I ultimately believe that we will test the 1.75 handle, although it will take a Herculean effort to get above the 1.70 level as it is significant resistance on the longer-term charts. The real question will be whether or not we can come up with that momentum during the summer break?