The GBP/USD pair did very little during the session on Monday, but that’s not a huge surprise considering both the United Kingdom and the United States have holidays. Although it’s obviously a market that’s traded around the world, when the 2 currencies are held by 2 countries are both taking the day off, you really can’t expect much.

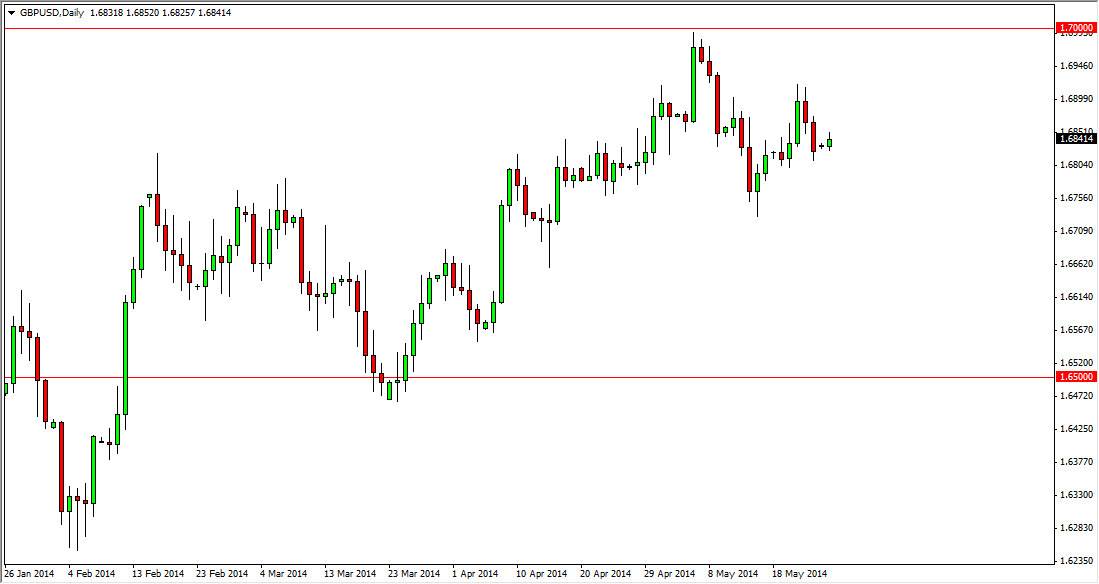

That being said, it appears that the 1.68 level is going to hold is support, and as a result I believe that we will start going higher again, probably aiming for the 1.70 level at first. If we can get above there, then the market should go to the 1.75 level, but I think it’s going to be a bit of a challenge to break out as the area is a major resistance level on longer-term charts, something that is most certainly on the minds of most traders around the world.

Remember, there is a little bit of a “risk on” aspect of this market going higher.

Remember, there is a little bit of a “risk on” aspect to this market going higher when people start selling the US dollar. Granted, the British pound is in exactly what I would call a “risky asset”, but the US dollar is considered to be the safest currency hold. With that, if the currency markets are reflecting what’s going on around the world, generally this pair will rise with stock markets and the like. On the other hand, if the stock markets start falling, it wouldn’t exactly be surprising to see this market fall as well. Nonetheless, I think the 1.60 level will continue to be supportive, and I am most certain that the 1.65 level would be massively supportive. In fact, we have to get below the 1.65 level before I would even consider selling this pair.

All things being equal, I will continue to buy on the dips as is market will almost certainly attract buyers back time and time again. Once we get above the 1.70 level, I began a buy-and-hold type of trader until we hit the 1.75 handle.