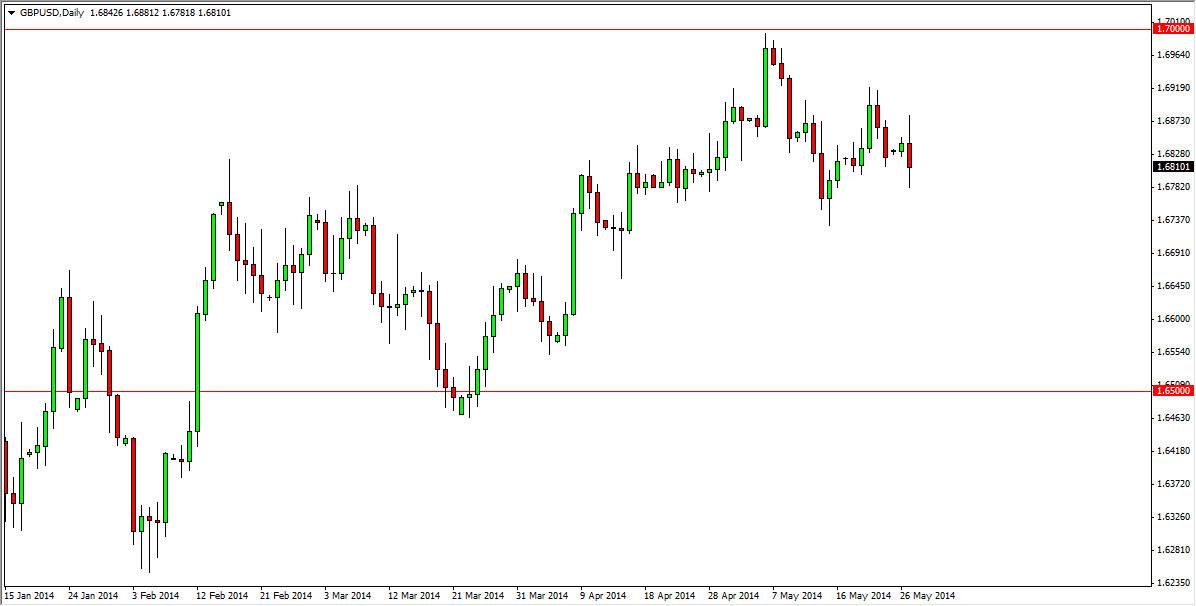

The GBP/USD pair went back and forth on Tuesday, ultimately settling on a slightly negative candle. We had a pretty volatile session, so I think this just goes to show how choppy the markets could be in the short term. It appears that the 1.68 level should continue to be somewhat supportive, and with that I believe that this market will probably continue to be somewhat buoyant. However, I do recognize that there’s probably a lot of volatility ahead, so you will have to keep that in mind if you get involved. Quite frankly, it’s possible that you may be better off playing the options market going forward.

I believe that the 1.70 level will be targeted, but the next couple of sessions will probably feature range bound trading, as it appears to be the case in several of the other Forex pairs that I follow. I certainly would not be selling this pair though, because I see far much more risk to the upside than the down, and in a choppy environment like this I always prefer to go with the trend anyways.

Short-term strategy.

I will be looking for short-term supportive candles in order to start buying and aiming for small gains time and time again. I believe that ultimately we will reach that aforementioned 1.70 handle, but that it won’t necessarily be the easiest move. That being said though, I’m just not comfortable shorting a market that has this much obvious support just below.

Even if we broke down from here, I believe that 1.65 would be a “floor” in this market, and that it would represent enough value that traders would certainly start to step in hand over fist at that point. It really isn’t until we clear well below the 1.65 handle that him comfortable selling in this market as the British pound has done so well. If we can get above 1.70 level however, at that point in time I believe this has suddenly become a buy-and-hold market, and would trade accordingly.