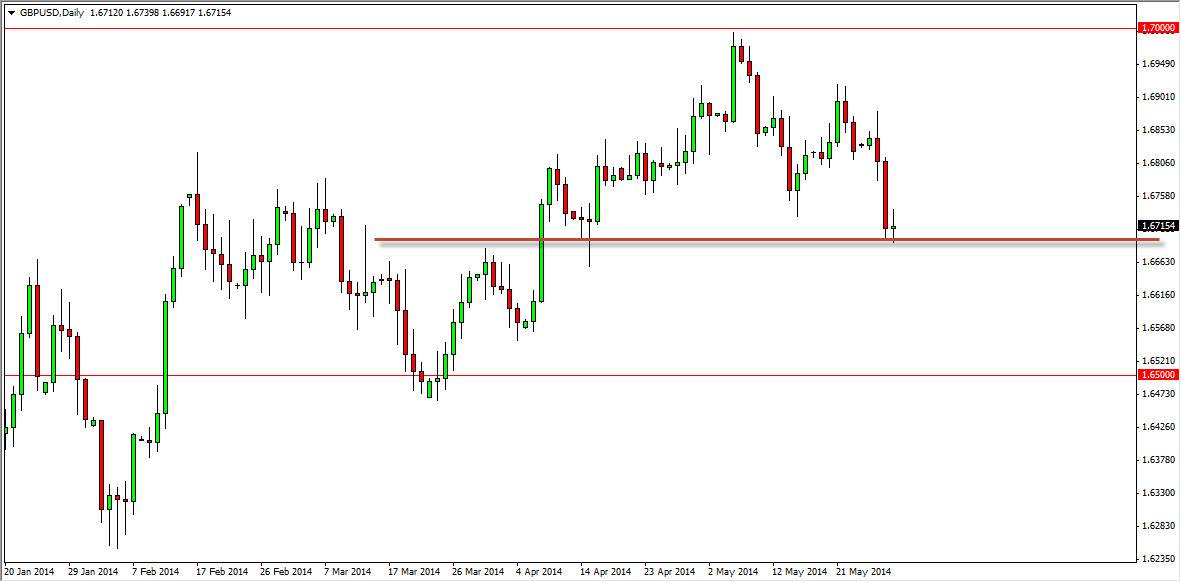

The GBP/USD pair did very little during the session on Thursday, as the 1.67 level held tight. The fact that we ended up forming a neutral candle like this at that level with very little in the way of range, tells me that this market could in fact bounce from here as the support seems to be holding steady. That being the case, it is also worth noting that the 1.67 level is the “midline” between the high of the consolidation area at the 1.70 level, and the low which of course is the 1.65 level. In other words, the market is roughly at where we would consider “fair value.”

All things being equal though, we are in an uptrend so I believe that the perceived fair value area should be supportive. Ultimately, the market should go a bit higher given enough time, and a break above the highs of the session from the Thursday trading hours would be reason enough for me to start buying. I think all things being equal we should go to the 1.68 level first, and then eventually back to the 1.70 handle.

Uptrend shouldn’t be argued against.

The 1.70 level is a major support and resistance level on the longer-term charts, so it does not surprise me at all that the area ended up being resistive enough to push the market back down, and that the market may have to build up enough momentum to breakout eventually. Because of this, I feel that the market will eventually breakout, but it may take several attempts to do so. In other words, pullback should offer value as we continue to find buyers to push above this major area. The good news of course is that if we get above the 1.70 handle, this pair could go much, much higher given enough time. Also, most of the brokers out there will offer a positive swap in this pair, so you can get paid to hang onto that buy-and-hold type of situation. However, in the meantime we need to find a burst tire in order to start buying.