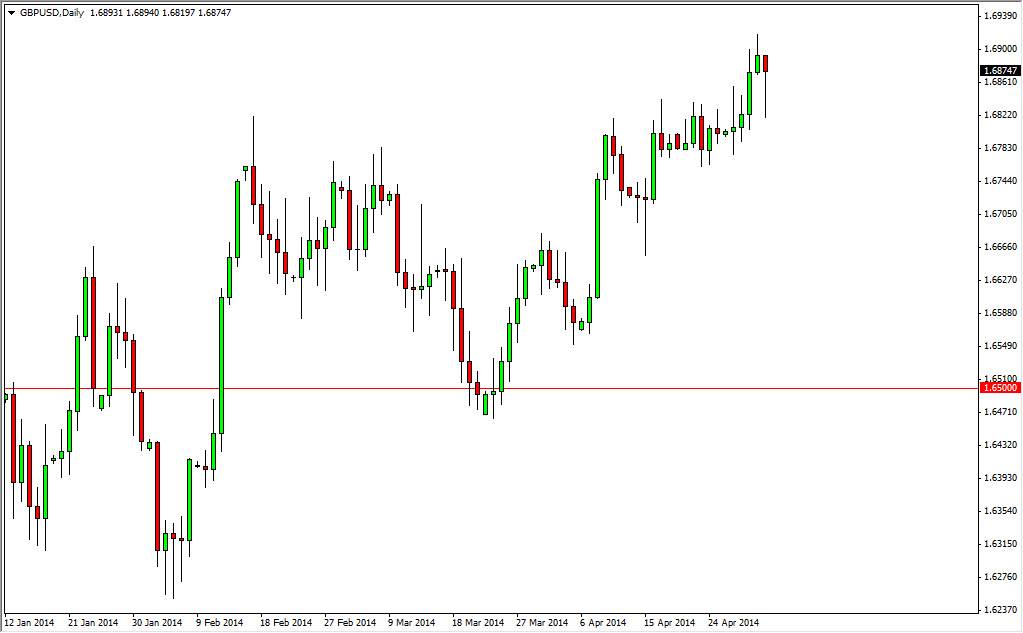

The GBP/USD pair fell during most of the session on Friday, but found enough support at the 1.68 handle to turn things back around and form a hammer. This area was a significant area of consolidation during the last couple of weeks, so it’s not a big surprise. After all, the nonfarm payroll numbers, although having a strong headline number, really didn’t show a lot of strength underlying that number. The majority of the job gains were again from people leaving the workplace, not exactly a sign of economic strength.

The fact that the market formed a hammer suggests that we are continuing to go higher eventually, and the 1.69 level will get broken above. If we get that, I feel that the market will make its move towards a 1.70 level, an area that I have been targeting for some time. The British pound has been a bit stronger as of late, and with the US dollar looking little bit suspicious, it’s not a big surprise we see that move.

Buying on the dips.

I suspect that there will be a lot of short-term traders out there buying on the dips in this market as it certainly is in an uptrend. Ready, it’s been a bit choppy from time to time, but ultimately it’s been very reliable since we broke through the 1.65 handle. I believe that the market probably won’t see a 1.65 print anytime soon, but that would be the ultimate “floor” in this market. In other words, I am not willing to sell this market until we get well below that level, something that I do not anticipate seen anytime soon.

Having said that, I believe that the 1.70 level will more than likely offer a bit of resistance though, so pullback from that area might bring in people looking for value as the British pound would be cheap at that point. I do think that ultimately we break above the 1.70 handle, and continue much higher. Nonetheless though, that will be a significant fight in my opinion.