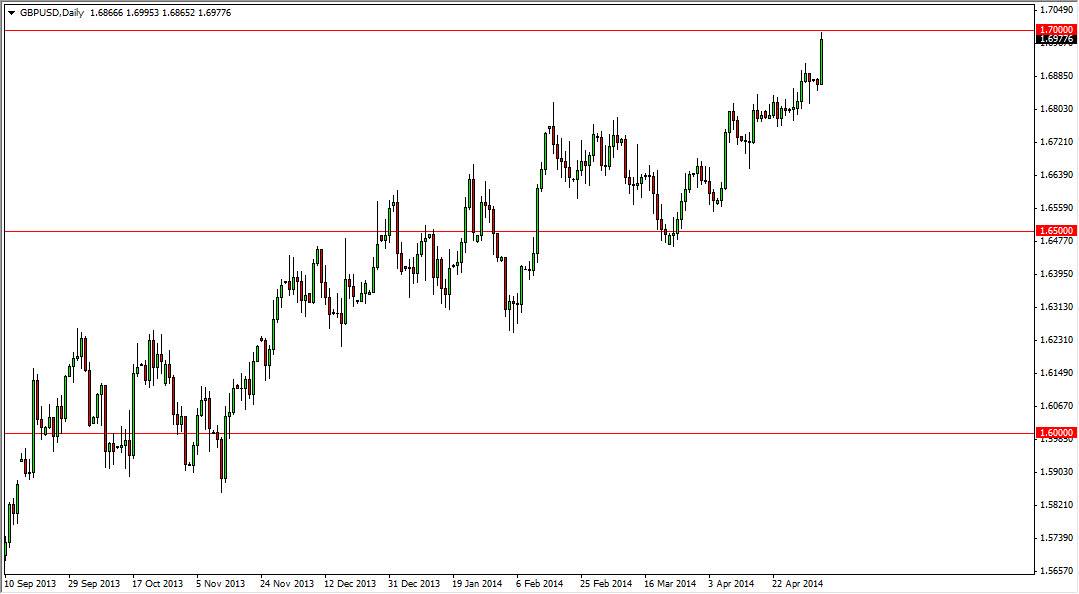

The GBP/USD pair rose during the session on Tuesday, slamming into the 1.70 level. This candle was bullish also, and as a result the market is certainly positive overall. The trend is strong, and this latest move shows that there is still an underlying strength to this market still. This validates what I have been forecasting for some time, as the 1.70 level was the target. With this, I have to reevaluate my position in this market.

It isn’t that the market direction is a mystery to me, I know that I can only buy this pair. The fact is that the level above is strong enough that I would suspect the market is ready to pull back from here. The pullback should simply collect buyers going forward. This should be an exercise in momentum building, and could be necessary for the market to breakout above the 1.70 handle, which is in fact resistive on the longer-term charts as well.

Major breakout @ 1.70

If we get above the resistance level on a daily close, I think this market will go much, much higher as it would become a buy-and-hold situation going forward. The market will undoubtedly be a “buy on the dips” situation as the Pound continues to strengthen overall. The 1.68 level offers support below, and possibly the 1.69 level as well. The truth is no matter what, I am a buyer, and looking for supportive candles in order to get long.

On the other hand, if we break out above the 1.70 level, I think that we will see a flood of short covering in the initial move, sending this pair into one of the best trading positions for me. I think that ultimately this pair does in fact go higher, and I couldn’t image selling at this point at all. In fact, I am not a seller until we get below the 1.65 handle – something that isn’t going to happen anytime soon. Anyone who is looking to short this market from a short-term perspective is probably going to be taught a lesson in trend following….