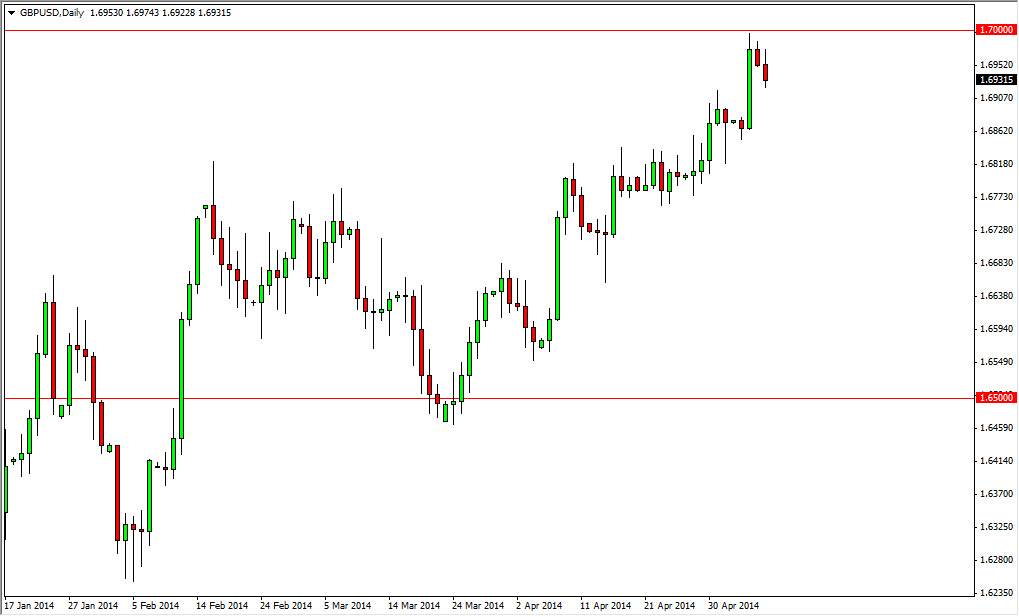

The GBP/USD pair initially tried to rally during the session on Thursday, but as you can see the sellers stepped back into the marketplace and pushed the market down. Nonetheless, I feel that this market has plenty of support below, and that we are simply pulling back in order to find enough buyers to breakout above the 1.70 handle, an area that is a significant and massive resistance area. That resistance area giving up would in fact be a massive signal to start buying and holding onto the British pound. I believe that the market could in fact break much higher, as it would be essentially like the proverbial “beach ball held underwater.” This means of course that once we breakout, the market will shoot straight up. That doesn’t mean that we will never pullback, quite frankly a pullback is good, and would bring buyers into continue to push the market higher.

Well supported below as well.

This market of course as well supported below as well, as we have seen such a nice uptrend some time now. Every time this market has pulled back, we have seen buyers step back into the pair. I don’t think anything’s going to change that at this point, and now it’s just a matter of waiting for the right supportive candle. I think that the 1.69 level is very supportive, just as the 1.68 handle is. Any type of supporting candle in that general vicinity would be interesting to me as continuation should be the way that this market moves.

If we break down below the 1.67 handle that of course would be a different story but I really don’t see that happening at this point. Ultimately, I see this market heading to the 1.75 level, and then possibly even higher than that as a break above the 1.70 handle is a major breakout on longer-term charts as it would signal that we are recuperating after the massive meltdown in the financial markets a few years back.