GBP/USD Signal Update

Yesterday’s signals expired without being triggered as the price never reached 1.6790.

Today’s GBP/USD Signals

Risk 0.25%

Entries must be made before 5pm London time today.

Long Trade 1

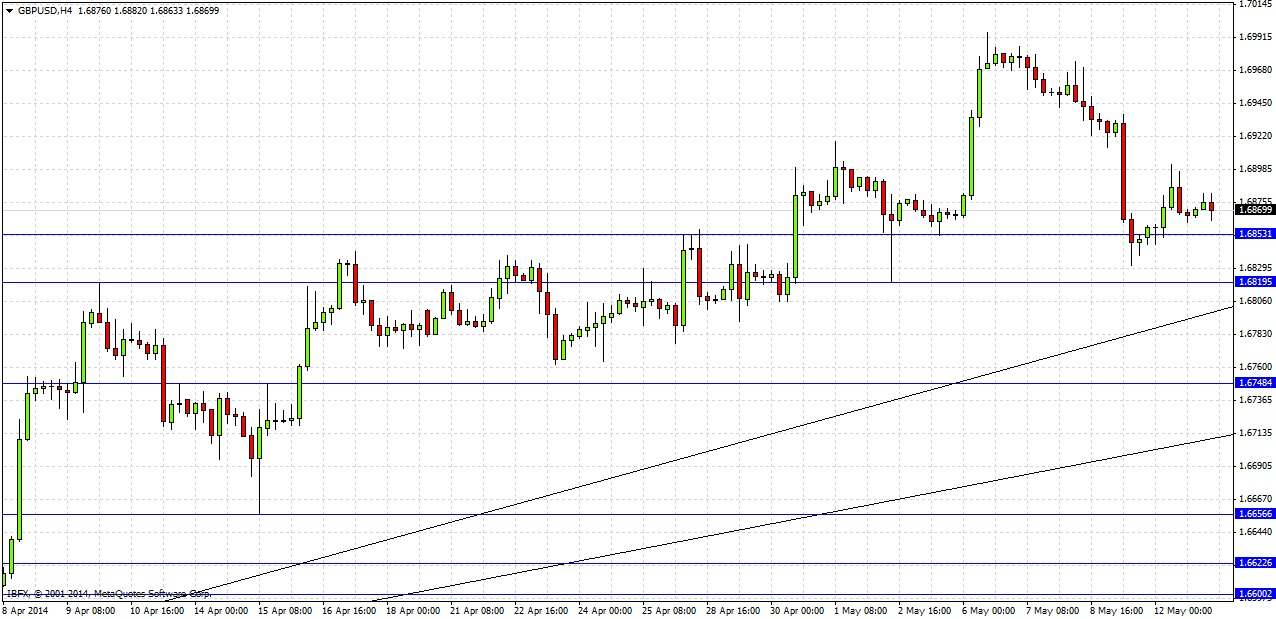

Long entry after confirming bullish price action on the H1 chart following the first touch of the bullish trend line sitting at around 1.6805.

Put a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price reaches 1.6850.

Take off 50% of the position as profit at 1.6850 and leave the remainder of the position to run.

Long Trade 2

Long entry after confirming bullish price action on the H1 chart following the first touch of 1.6748.

Put a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price reaches 1.6800.

Take off 50% of the position as profit at 1.6800 and leave the remainder of the position to run.

GBP/USD Analysis

I said yesterday that the upwards trend remains intact and that the GBP along with the NZD remains the strongest global currency, having occupied this position for a while now.

Yesterday was a fairly quiet day with the price pulling up a little from a mushy support zone that begins below us at around 1.6853 and continues downwards to about 1.6820. A little below that there is a bullish inner trend line currently sitting at 1.6805. This trend line could provide a good buying opportunity especially in a few hours when it becomes confluent with the 1.6820 level or above.

Below that we have another, more long-term and probably stronger trend line, and a very key psychological support level at 1.6750, which would also be another good spot to look for buys.

There are no obvious good flipped resistance levels before 1.7041 so it is not worth thinking about any shorts yet.

There are no high-impact news released scheduled today concerning the GBP. At 1:30pm London time there will be a release of US Retail Sales and Core Retail Sales data.