GBP/USD Signal Update

Yesterday’s signals were not triggered as the price blew right through 1.6864, so there was no bearish price action to trigger the short trade there.

Today’s GBP/USD Signals

Risk 0.75%

Entries may be made only before 5pm London time today.

Long Trade 1

Long entry after confirming bullish price action on the H1 chart following the first touch of 1.6864.

Put a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price reaches 1.6900.

Take off 50% of the position as profit at 1.6895 and leave the remainder of the position to ride.

GBP/USD Analysis

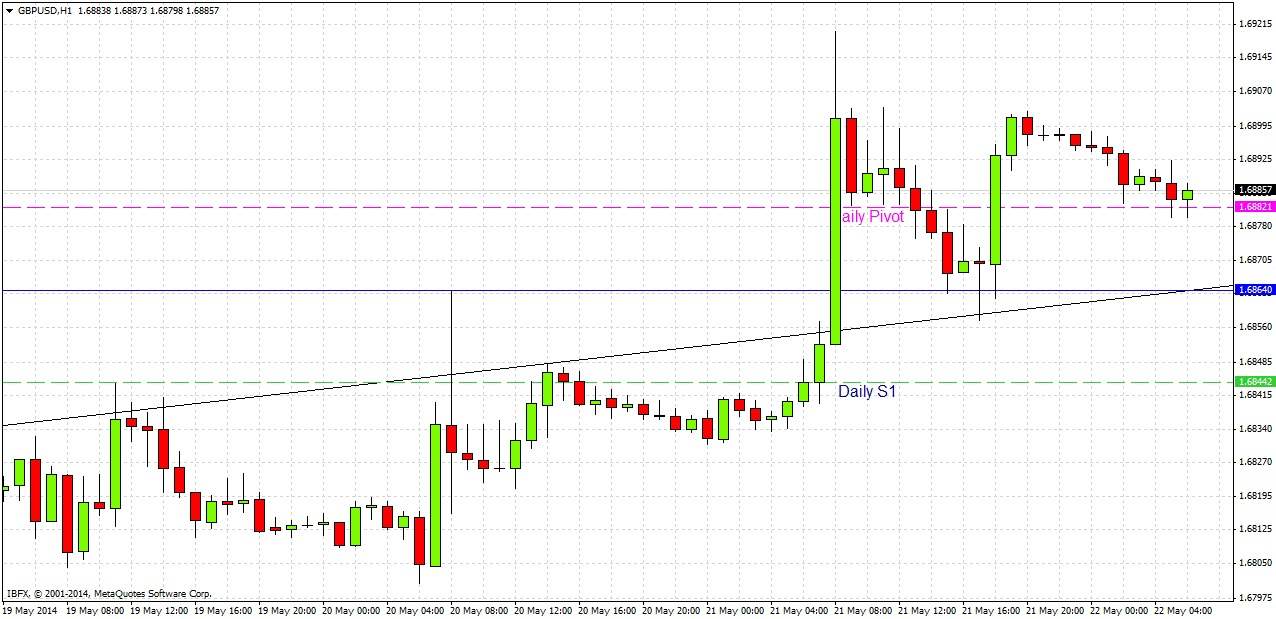

Yesterday I wrote that we are in an uptrend and might take a short at 1.6864 but needed to be very conservative about that. I was right in both cases, in that the uptrend continued, and that any short at 1.6864 needed to be confirmed by price action. Following this kept us out of what would have been a disastrous short trade.

Looking at the hourly chart, we can see that this pair is very technically interesting today. Yesterday we blew through the pivotal point of 1.6864, then fell back to retest from the other side both it and the broken inner trend line, which held very precisely and gave us another bounce up.

Although it is a little risky to look for another bounce so soon, as we are in a strong uptrend and have recently bounced off a very long-term bullish trend line, I would go today for a long off the pivotal level at 1.6864 which seems to have flipped from resistance to support, provided that it is confirmed by bullish price action on the hourly chart. If the action rejects the inner trend line as well, that would be even better.

The news release at 9:30am London time might well spike the price down to 1.6864 or below.

There is important news sue today for both the GBP and the USD. At 9:30am London time there is the second estimate of the quarterly U.K. GDP. Later at 1:30pm there are U.S. Unemployment Claims data followed by Existing Homes Sales at 3pm. This pair should be fairly active today.