Gold weakened against the American dollar for a third session on Wednesday after the Federal Reserve announced that it will cut monthly purchases by another $10 billion to $45 billion. The Federal Open Market Committee also said “...it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program ends, especially if projected inflation continues to run below the Committee's 2% longer-run goal..." at the conclusion of a two-day meeting yesterday.

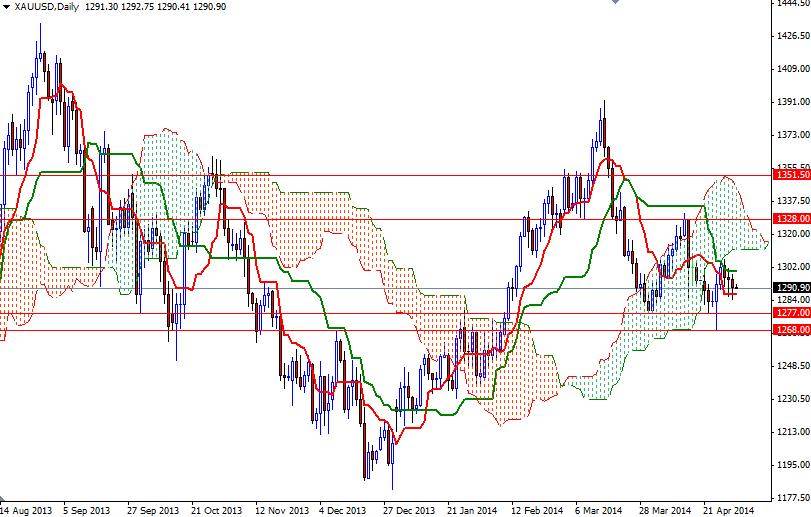

Wednesday's data from the world's biggest economy were mixed. Automatic Data Processing research institute said companies added 220K workers in April, well above expectations of 203K but the Commerce Department's GDP figures came out weaker than forecasts. It appears that persistent rally in equities is another element dulling the shiny metal's attractiveness. Technically speaking, trading below the Ichimoku cloud (on both the daily and weekly time frames) is highly negative for gold prices.

However, the XAU/USD pair has been range bound since we entered the cloud on 4-hour chart and as you can see the 1285 level has been supportive recently. If the bears can increase selling pressure and shatter this support, it is very likely that the pair will revisit the 1277 level next. A close below this level would suggest that 1268 will be the next target. To the upside, the bulls will need to break through the 1300 resistance level where the top of the cloud sits (4-hour chart) in order to gain more traction and reach the 1307 level. Beyond that, the bears will be waiting at 1311 and 1316.