The XAU/USD declined 1% for the week as the conditions in the marketplace dulled desire for safe haven diversification. The latest reports released from the Unite States provided further evidence that the labor market and economy are strengthening. Aside from the improving economic data from the United States, signs of slowing growth in China have been weighing on the precious metal.

However, caution over the situation in eastern Ukraine is somehow limiting the bears' advance. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 97956 contracts, from 85227 a week earlier. I think the gold market remains vulnerable to another flare-up in tensions between Russia and Ukraine but the candlesticks indicate lack of momentum at the moment.

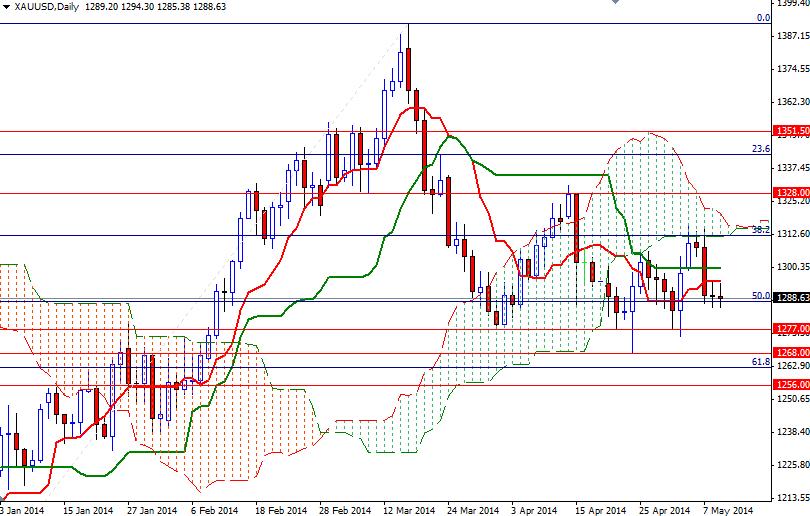

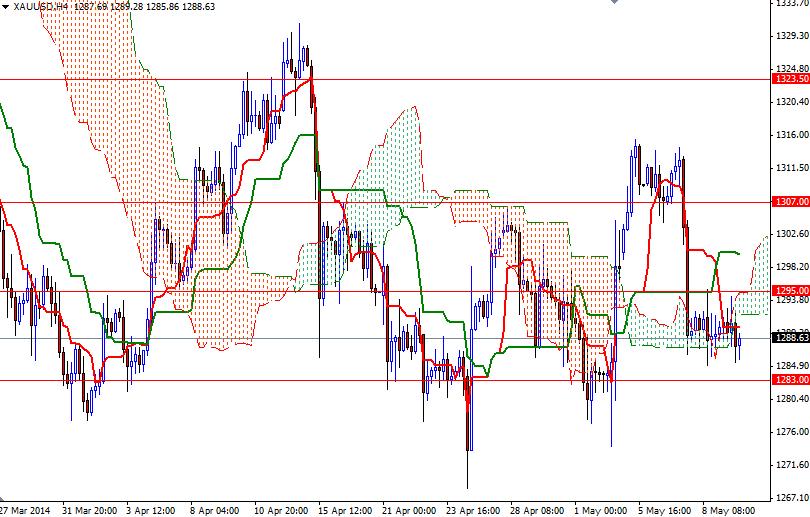

The XAU/USD is trading below the Ichimoku cloud on the weekly and daily charts. We also have bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses on the daily and 4-hour time frames. This suggests that the bears will have advantage unless the pair anchors to somewhere above the 1316.20 level where many forms of resistance (such as the top of the cloud and Fibonacci 38.2) converge. On the other hand, the bears still need to drag the market below the 1277 support level in order to gain enough strength to challenge the bulls camping around the 1268 level. The first resistance ahead of us is located at 1295.20 where the Tenkan-sen line currently resides. If the market breaks through, the 1300 - 1307 area will be the next possible target.