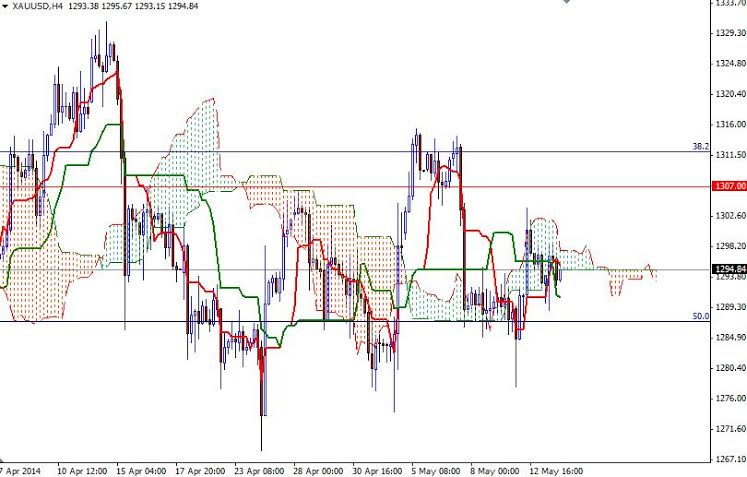

Gold prices (XAU/USD) ended yesterday's session with a loss as strength in the U.S. dollar and equities markets lured some investors away from the precious metal. Increasing demand for the American dollar tends to weaken the appeal of commodities such as gold but caution over the situation in eastern Ukraine is still limiting the down side. As you can see on the charts, the gold market has been going back and forth in a relatively tight range for the last 4 weeks and because of that the lack of strong momentum will certainly be something to watch.

On the weekly and daily time frames, the XAU/USD pair is still trading below the Ichimoku clouds and from a technical perspective that means there is more resistance to the upside at the moment. Although there is potential for further declines, I think the 1277 - 1268 area, which the bulls have been fighting hard to defend, will continue to play a critical role. As I told in my previous analysis, according to charts, the odds favor a range bound movement.

In the meantime, the first challenge will be waiting the bulls at 1307. If prices break through, then I think the bulls will be aiming for 1316/8. A daily close above the 1318 level (which also happens to be the top of the cloud on the daily chart) would make me think that the market will attempt to advance towards the next strong resistance at 1328. If prices start to fall, expect to see some support at the 1284 level. A drop below 1284 would suggest that the next stop will be the 1277 level. If the bears win the fight and drag prices below 1277, possibility of 1268 printing on the chart will increase.