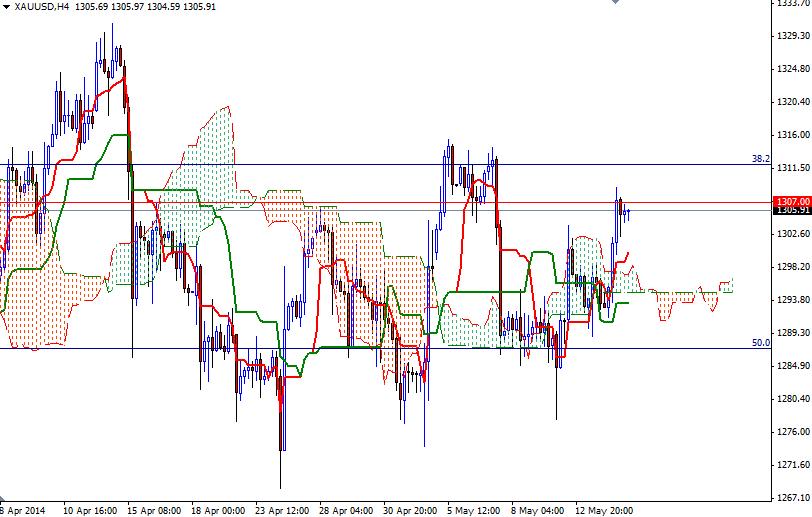

The XAU/USD pair (Gold vs. the American dollar) scored a gain of 0.86% yesterday as flare-ups in Ukraine and uncertainty in the U.S. stock market combined to provide support to the precious metal. Armed rebels continue to occupy some government buildings in the eastern portion of the country and Western officials still believe that Russia is behind the unrest. Support from the intensifying concerns over Ukraine offset earlier pressure from signs that the ECB will cut interest rates at its next policy meeting and helped the XAU/USD pair climb above the Ichimoku clouds on the 4-hour time frame.

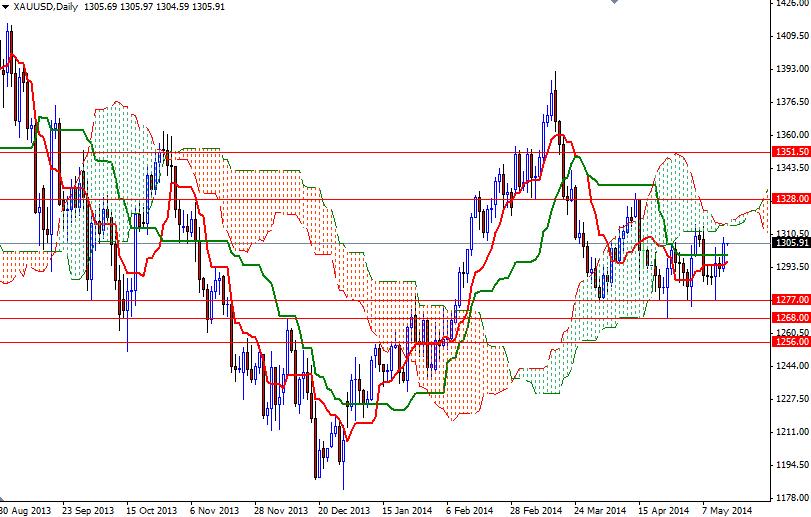

However, the Ichimoku cloud on the daily chart has been offering heavy resistance and the area between the 1277 and 1268 levels has been supportive. In other words, the pattern on the charts suggests we are going to be range bound in the near term while the market simply has no real catalyst to push prices in either direction. If the bulls build some steam and climb above yesterday's high, then the market will probably have enough momentum to test the 1316 - 1318 area.

A daily close beyond this zone would lure some investors back to the market and increase the possibility of a bullish attempt to test the 1328 resistance level. If the bulls fail to push and hold prices above the 1307 level, we could go back to the 1294 support level. A break below 1294 would indicate that the bears are going to aim for 1287 - 1284.