The XAU/USD pair fell for a fourth consecutive day as investors’ confidence in gold was eroded after the bulls failed to push prices above the 1293 resistance level. The pair traded as low as $1277.19 an ounce on the back of better-than-expected U.S. economic figures. The Institute for Supply Management reported that the index of manufacturing activity jumped to 54.9 from 53.7 and according to the Commerce Department's figures, consumer spending climbed 0.9% in March.

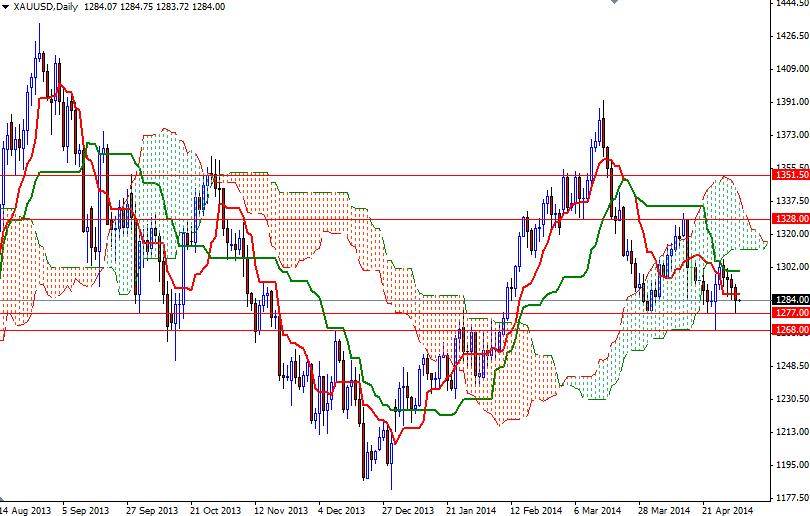

Although the pair recovered some of its earlier losses, the technical outlook still looks gloomy. In my recent analysis, I have been telling that there was more resistance to the upside because of the location of the Ichimoku clouds on the weekly and daily charts. Technically speaking, the Ichimoku cloud indicates an area of support or resistance and in our case the clouds are representing resistance zones.

From an intra-day perspective, the key levels to watch will be 1277 and 1293. The bears will have to pull prices below 1277 in order to challenge the bulls at the 1268 level where the pair had found significant amount of support last week. A break below this level could send prices back to 1256. However, if the bulls manage to push prices up and break through the resistance at 1293 level, they might have a chance to tackle the 1300 level. The main event of the day clearly will be the release of the government’s employment figures.