The XAU/USD closed yesterday's session slightly higher than opening as declines in the major stock markets lured some investors back to safety of gold. For quite some time, the precious metal has maintained an inverse relationship with stocks and acted as a hedge against financial or geopolitical turmoil. The pair traded as low as $1285.89 an ounce but price reacted with bullish sentiment after hitting that low and moved back up.

Since mid-April gold prices have been consolidating roughly between 1316 and 1268 but eventually the market will soon reach a point where it will simply have to break one way or the other - tightening trading range usually suggests a pending strong move. The market seems steady during the Asian session as most investors are waiting for the minutes of the Federal Open Market Committee meeting held on April 29-30. Fed’s policy meeting minutes, which will be released later today, may provide clues on the timing of a future hike to interest rates.

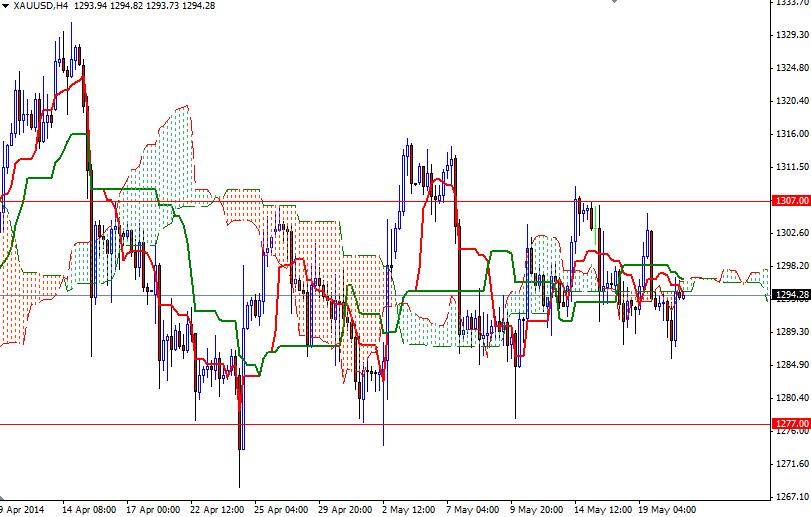

In the meantime, I will be keeping an eye on the 1307 and 1287/3 levels. If the bulls start to charge, climbing above the 1307 resistance would be necessary to gain enough traction to tackle 1312 and 1318/20. Only a sustained break above the 1320 could extend the bullish movement towards 1328. However, if the bears clear the support at 1287/3, I think the XAU/USD pair will be testing the support at 1277 next. Once below that level, the real challenge will be waiting the bears at 1268.