Gold priced ended yesterday's session with a loss as strength in global equities helped draw investors away from the precious metal. The XAU/USD pair touched its lowest level in seven days after the minutes from the Federal Open Market Committee's latest gathering showed policy makers see a muted risk of inflation from ongoing asset buying program. At the same time, the Fed repeated that it will not raise interest rates anytime soon.

According to the records, “... it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program ends, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal”.

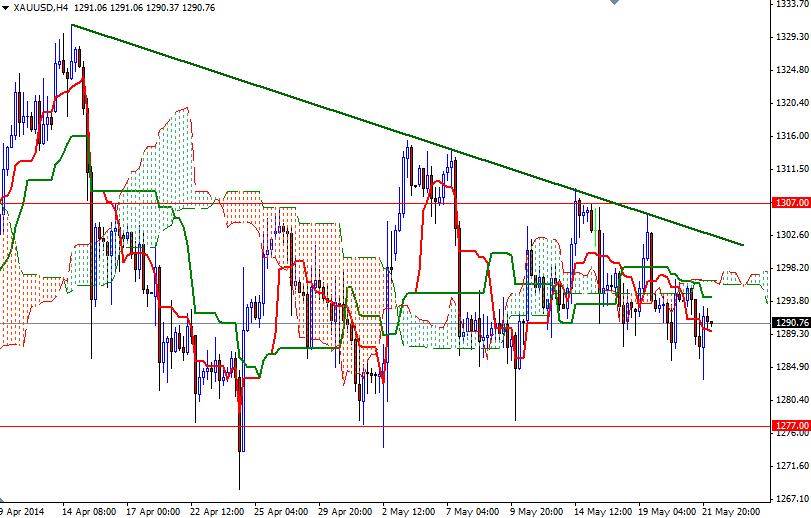

From a technical perspective, I think there are a couple of things to pay close attention. First of all, the XAU/USD pair is trading below the Ichimoku clouds on both the weekly and daily time frames, indicating that the path of least resistance for gold appears lower. Basically, the overall trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself. In addition, there is a descending trend line dating back to the April high of 1331.02.

If the buyers start to gain their strength and the pair anchors to somewhere above the 1307 level, there could be a run all the way back to the 1328 level. On its journey, there will be hurdles at 1312/13 and 1318/20. To the down side, the bears will have to drag the XAU/USD pair below the 1287/3 zone in order to increase pressure. If that support gives way, it is possible to see a bearish continuation to the next key support level of 1277. Closing below 1277 would suggest that our next stop is the 1268 level.