The precious metal has been struggling lately as interest rates talk and a friendly risk environment have provided better investment opportunities elsewhere. Gold prices were essentially unchanged last week, closing at $1292.66 an ounce. Rising house sales and manufacturing activity show the U.S. economy is improving and there are signs that the labor market is stabilizing.

Most believe that the Fed is mostly likely to maintain its tapering schedule and rate hikes could begin at some point in 2015. The major focus of the new week is likely to be the Ukrainian elections (and Russian President Vladimir Putin's reaction to the outcome). If Russia accepts the results and investors' appetite for the shiny metal decreases, the bears may want to take advantage of the situation. However, if Russia doesn't recognize the result and continue to pressure Ukraine, the bulls might find extra support they need to push prices higher.

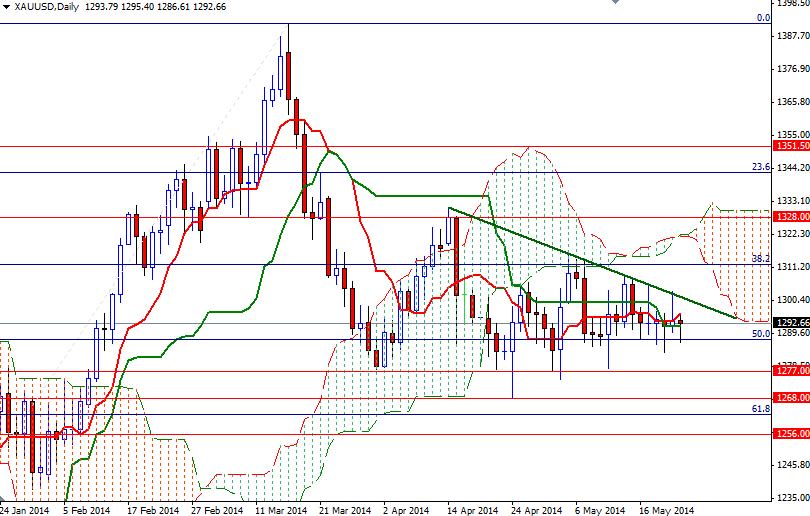

Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 96491 contracts, from 91634 a week earlier. Technically, gold prices are showing a tightening trading range which suggests a pending strong move, either way. While the Ichimoku clouds on the weekly and daily charts act as strong resistance, so far the bulls have defended the 1277 - 1268 support area persistently. From an intra-day perspective, I think the key levels to watch will be 1307 and 1283. If prices drop below 1283, the bears could have a change to test the 1277 level. To the upside, the bulls will have to break through 1307 so that they can go further and tackle the 1312/13 resistance.