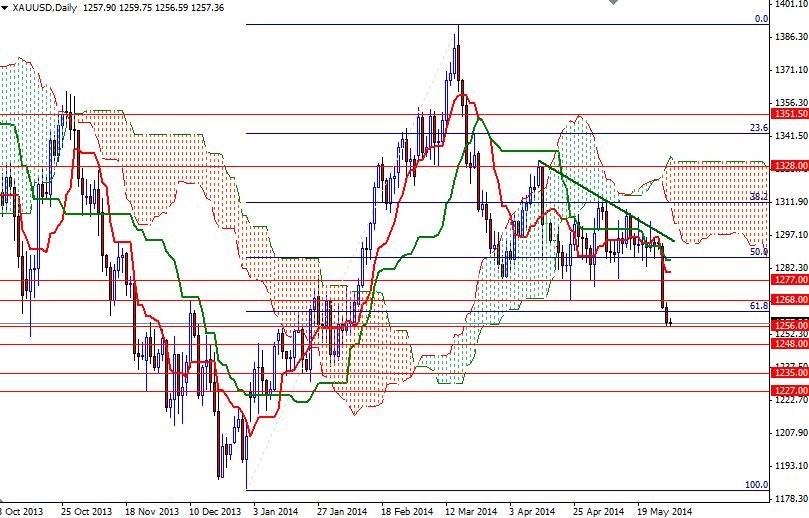

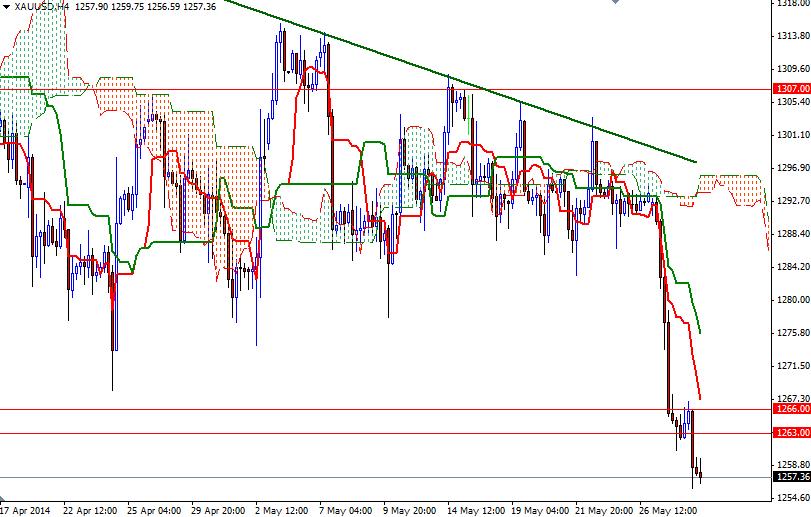

The XAU/USD pair extended its losses as a stronger dollar and technical selling pressure continued to weigh on the market. The pair traded as low as $1255.87 an ounce before recovering slightly to 1257.36 during today's Asian session. The pair had been trapped in a relatively tight range for the past four weeks and because of that closing below the 1277 support was a significant event. I think the recent price action reflects that desire to buy gold as a hedge against financial/geopolitical turmoil has diminished.

Good news on the U.S. economy will always be bad news for gold bulls, as expectation of a steady reduction in the pace of asset purchases by the Federal Reserve increases. Since the bearish side of the boat is getting crowded, investors will be paying more attention to today's U.S. GDP figures. Yesterday, the XAU/USD pair tested the first important support at 1256 as expected and I think breaking below this level is essential for a bearish continuation.

The pattern on the charts (and the fact that prices are below the Ichimoku clouds) suggests the broader directional bias remains weighted to the downside. That means any rebounds will attract sellers into the market until the technical outlook changes. If the market makes a sustained break below 1256, then 1248, 1240 and 1235 will be the next possible targets for the bears to capture. However, if the bulls manage to defend the support at 1256 and prices start to climb, expect to see resistance in the 1263/8 area. In order to ease selling pressure and head towards the 1277 level, the bulls have to push the XAU/USD pair above 1268.