The XAU/USD pair continued to sink yesterday and touched its lowest level since February 4. The pair traded as low as $1251.29 an ounce but recovered some of earlier losses after the U.S. GDP and pending home sales data fell short of market expectations. According to Commerce Department figures, gross domestic product contracted at an annual rate of 1% in the first quarter.

A separate report released by the National Association of Realtors showed the pending home sales index climbed only 0.4% in April after a 3.4% increase in March. Although the market still looks weak and there is potential for further declines, news of increased violence in eastern Ukraine and month-end profit taking could provide a lift to gold in the near-term. During the Asian session today the XAU/USD pair is trying to hold above the 1256 level. If prices hold above this level, the bulls might have a chance to visit yesterday's high of 1260.22 at least.

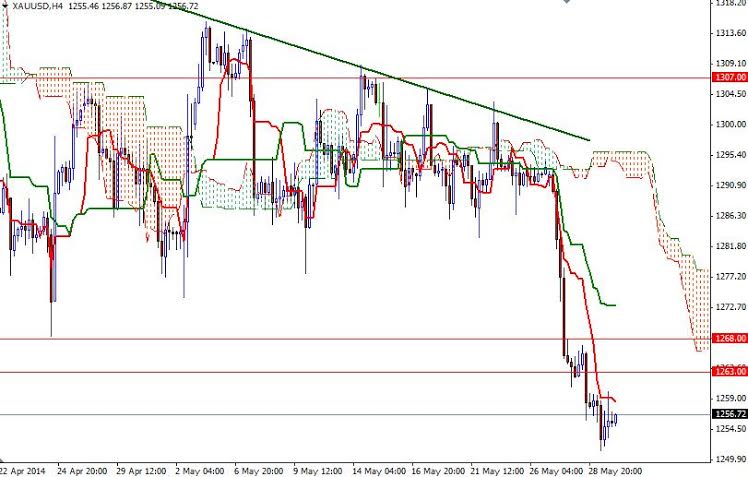

Beyond that barrier, there will hurdles in the way such as 1263 and 1268. At this point, only a close above the 1268 resistance level would make me think that the market is going to revisit the 1277 level. However, if gold prices fall below yesterday's low, it is likely that we will see the pair testing the next support level at 1248. Breaking this support would suggest that the 1240 level will be the next stop.