Gold gained ground for the first time in five days against the American dollar as geopolitical concerns returned to the forefront after the government in Ukraine launched a military operation to regain control of the eastern portion of the country and the United Nations held an emergency meeting. Support from the intensifying worries over Ukraine offset earlier pressure from an impressive U.S. jobs report and helped the XAU/USD pair to climb above the Ichimoku clouds on the 4-hour time frame.

Meanwhile, data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 85227 contracts, from 81833 a week earlier. It appears that investors grew increasingly worried about the threat of violence in Ukraine and further sanctions that will target large sectors of Russia's economy.

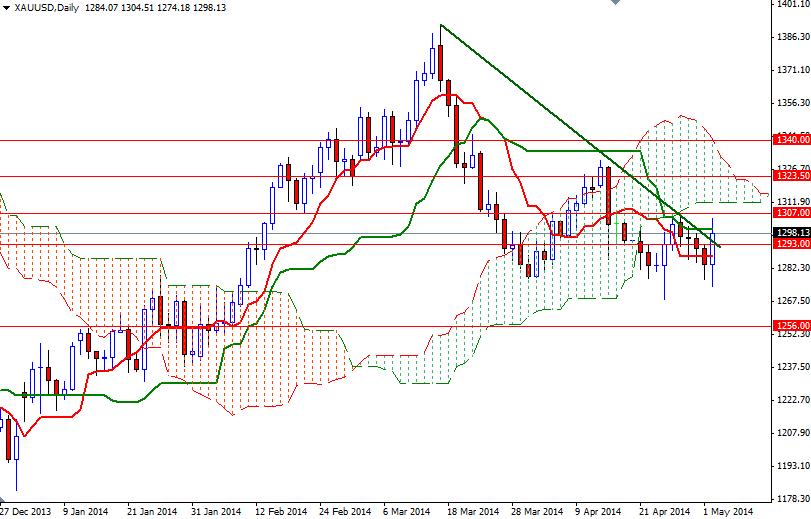

While Russia and Ukraine are dominating the headlines, the bears will struggle the get below the 1268 level which I had pointed out as a very significant support last week. Looking at the charts from a purely technical point of view, the odds favor further bounce as long as the XAU/USD pair trades above the Ichimoku clouds on the 4-hour chart but there will be strong resistance levels ahead of us.

If the bulls manage to shatter the first barrier at 1307, it is technically possible to see a bullish continuation targeting the 1311 - 1316.20 area. Breaking above this level might give the bulls extra power they need to march towards the 1323.50. To the down side, I will be watching the support area between1287 and 1283. If the bears take the reins and prices drop below that area, I think the 1277 level will be revisited. A daily close below the 1268 support level would suggest that the bears are firmly in control.