The XAU/USD pair posted first loss in three days but managed to close above the 1307 level. The pair traded as low as $1304.22 an ounce but prospect of a civil war in Ukraine pushed down stocks on major world markets and drove up buying of safe-haven gold. Lately, increasing unrest in Ukraine and perception that the Federal Reserve will not raise interest rates soon put a floor in gold’s trading range.

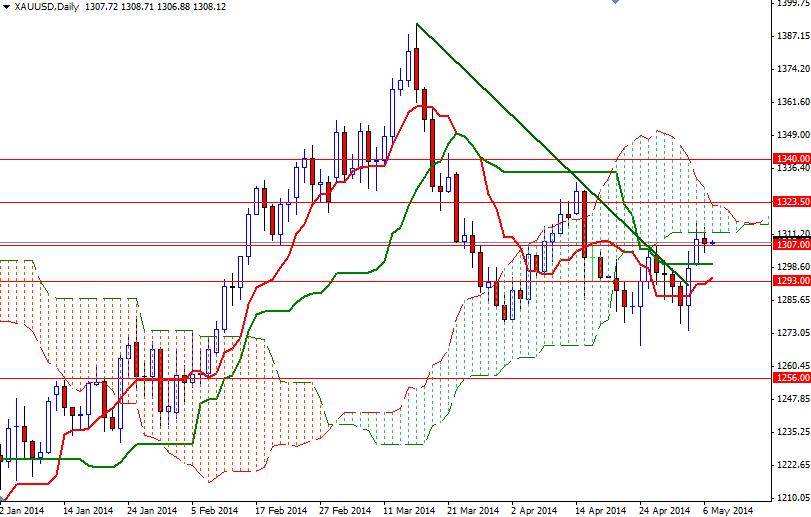

Last weekend, Federal Reserve Bank of Dallas President Richard Fisher said no decision will be made until October on actual timing. During the Asian session today prices are trying to form a bottom stay and above the 1304 support level. The XAU/USD pair is trading above the Ichimoku clouds on the 4-hour chart and we have a bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross.

That means selling is not an option at the moment because the bears don't have a complete control over the market. If the bulls can hold prices above the 1307 - 1304 support area, they might have another chance to tackle the resistance at 1316.20. The bulls will need to break through that level in order to gain more traction and reach 1323. However, if the bulls fail to penetrate the Ichimoku clouds on the daily chart and the prices drop below 1304, then I will look for 1299/8. Below that, there will be additional support at the 1293 level.