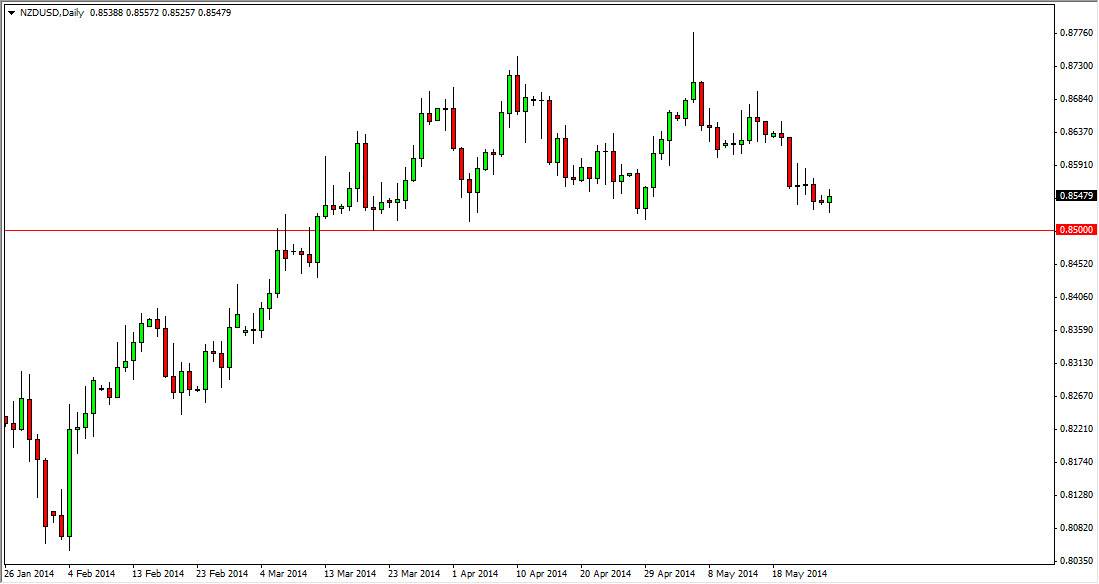

The NZD/USD pair did very little during the session on Monday, but with both the Americans and British celebrating holidays, it’s not a big surprise of the Forex markets were fairly quiet in general. Looking at this chart, it’s easy to see that we have been in consolidation recently, and that the 0.85 level is in fact very supportive. Because of this, I don’t think that this market is going to break down from here and would rather go long given half a shot. In fact, I normally wait for technical signals but could be convinced to simply buy blindly here. Certainly, if the 0.84 level gives way to the sellers, we would have a serious problem.

Ultimately, I believe that this market will continue to meander in the consolidation area that we been in, which means we should return to the 0.8750 level. With that, I am bullish but recognize that the market could very well go sideways for a large portion of this summer. After all, the New Zealand dollar tends to go sideways for long periods of time, followed by very impulsive moves. With that, we may be able to take advantage of a very well-defined range.

Learn how to arrange trade, you’re going to need it.

Learn how to arrange trade, you’re going to need it when it comes to this pair. However, I believe that’s going to be the case for most of the summer in most currency pairs. Range trading is simple, you simply buy at the bottom and sellers the top. Yes, eventually will be proven wrong but at the end of the day if you’re right 3 or 4 times and wrong once, you’re going to make money. It’s really not any harder than that although many people will try to make itself.

If we did break down below the 0.84 level, at that point in time I would be heavily shorted of the New Zealand dollar. However, I think it’s more likely that when traders come back after the summer break, we will head to the 0.90 handle, which has been my longer-term target for some time now.