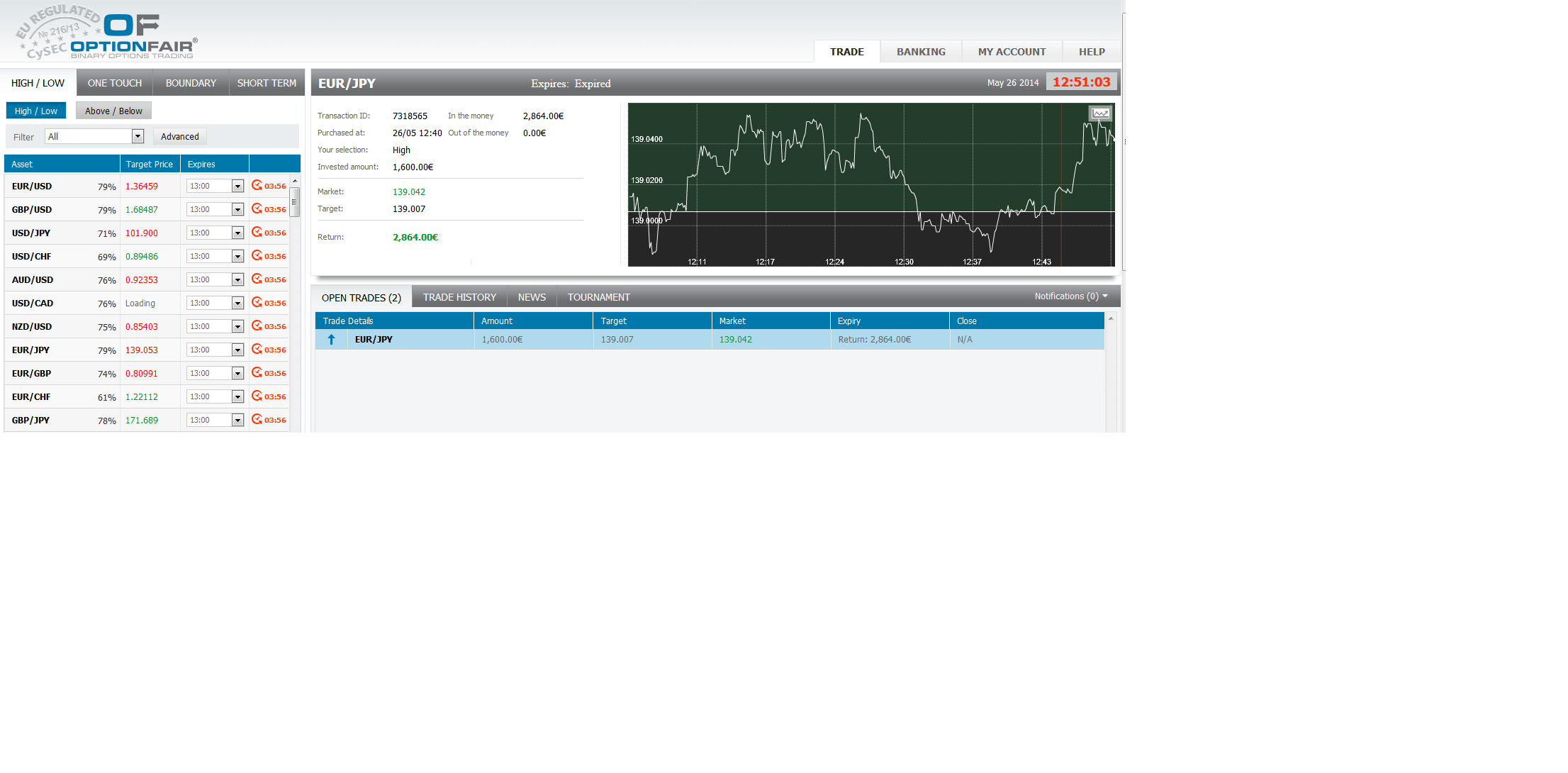

EUR/JPY

According to Christopher Lewis’s analysis of the EUR/JPY, “I think that the market will initially go to the 140 level” and “this pair should continue to go higher”. That creates an investment opportunity on the instruments: “High”, “Touch” and “No Touch down”.

I logged in the OptionFair™ binary options trading platform and I traded $1600 on the "High" instrument. This kind of option has a return of 79% if the option will close above the target price, which means that if the signal is correct I could get a return of $1264 on my investment.

The market price for EUR/JPY at the buying time (12:40) was 139.007 for the expiration of 12:50. The Asset closed on 139.042 and I made $1264.

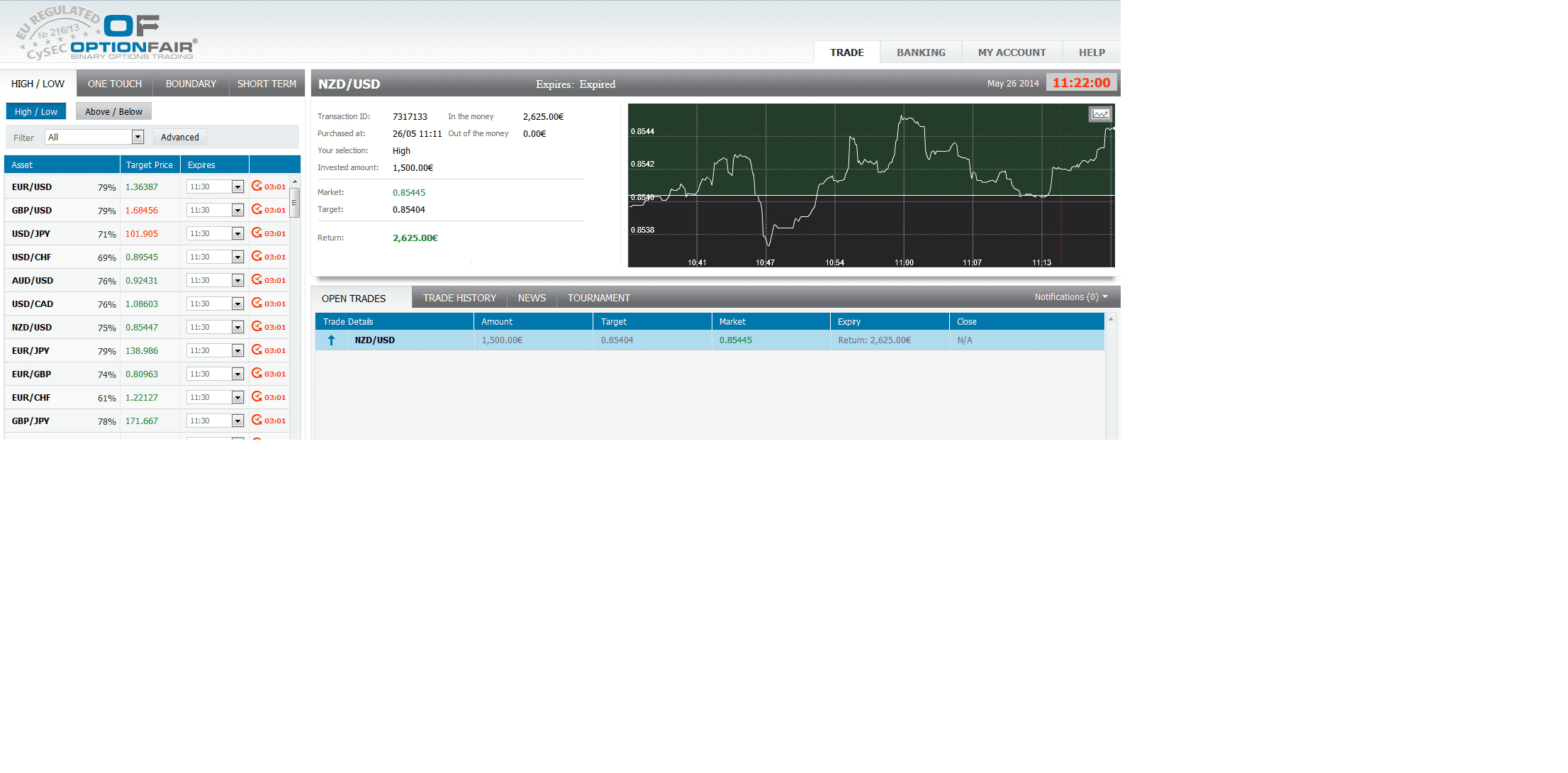

NZD/USD

Following Christopher Lewis’s analysis of the NZD/USD “A move above the 0.8750 level would signify a move higher”, an investment opportunity on the following instruments is created: “High”, “Touch” and “No Touch down”.

With OptionFair™ binary options trading platform, I traded $1500 on the “High” instrument. This kind of option has a return of 75% if the option touches the strike price prior to expiry, which means that if the signal is correct, I could get a return of $1125 on my investment.

The market price for the NZD/USD at the buying time (11:11) was 0.85404 for the expiration of 11:20. The Asset closed on 0.85445 and I made $1125.