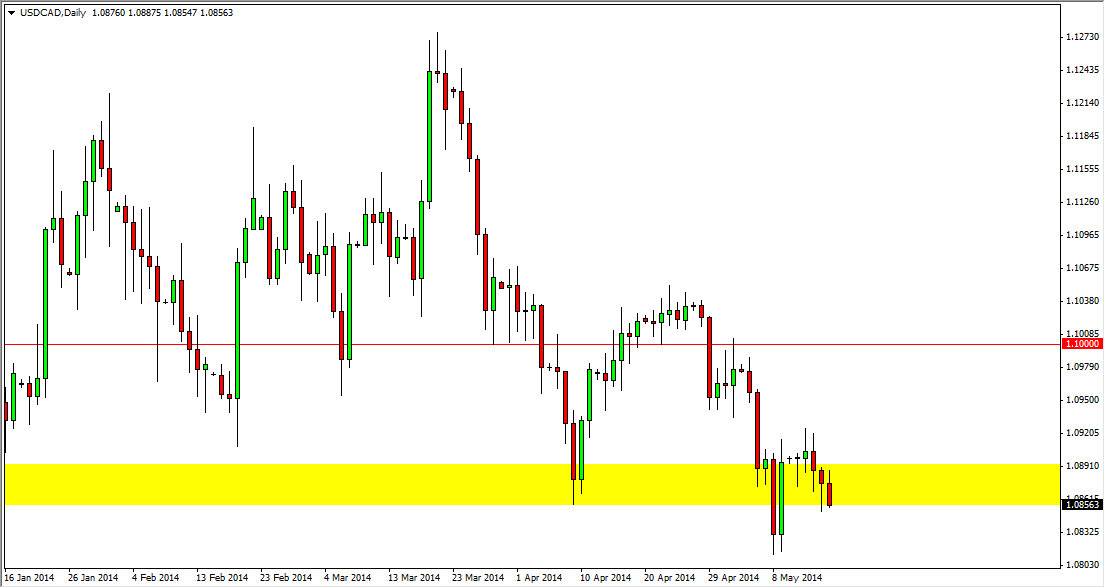

The USD/CAD pair tried to rally initially during the session on Friday, but as you can see the small cluster just below the 1.09 level held enough resistance and it to keep the market down a bit. We didn’t close below the bottom of the hammer from the Thursday session though, so we don’t assume have a sell signal either. However, all things being equal I am kind of concerned about the parent the moment as I think we could very easily break down from this level. It’s obvious to me that the 1.08 level is significant support as seen being the most recent low.

The oil markets will probably play a factor in this market to a point, but quite frankly they haven’t been as influential as we normally see them to be. With that in mind, I’m not putting too much faith in that, but do recognize that it could very well happen.

More upside than down.

There is more upside than down in this pair, as seen on the longer-term charts. Quite frankly, if we break down from here I think we will struggle to get below the 1.06 level, which has been very supportive in the past. Because of this, I feel that buying a longer-term pullback might be the way to go if we break down. Waiting for a couple of sessions to get the right supportive set up might be the way to go, and as a result I will be buying a break down in this pair, at least in the short term.

On the other hand, if we can get above the 1.0920 level, I think we will test the 1.1050 area again. That would make sense to me, but having said that, the market doesn’t look like it’s ready to do that quite yet. With that in mind, I will have to sit on the sidelines in this particular market and wait until I get the right candle to get involved. At this moment time, it obviously is in here for the taking in this market.