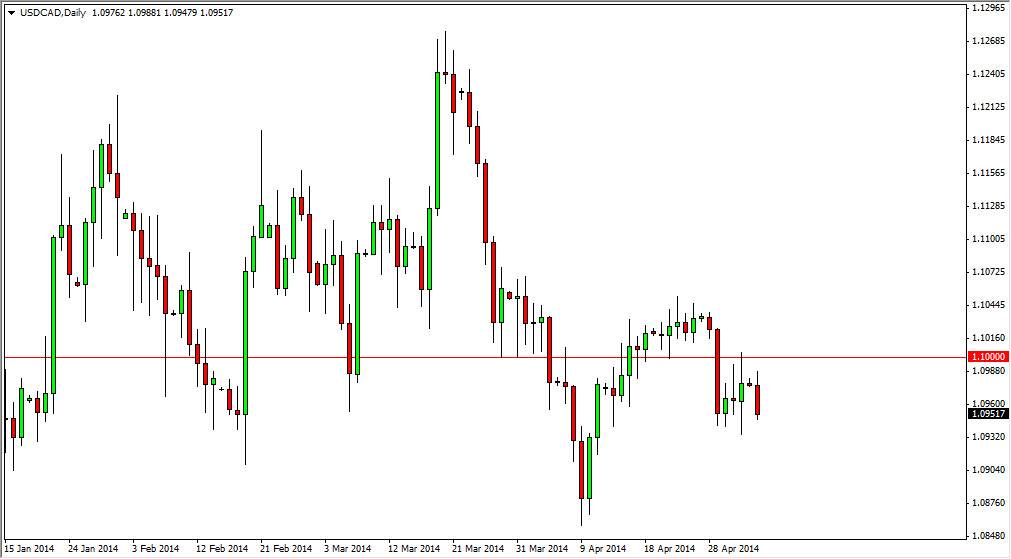

The USD/CAD pair initially rose during the session on Monday, but as you can see the 1.10 level offered enough resistance to keep the market somewhat down. Ultimately though, we’re still well within the recent consolidation area and more importantly above the 1.09 level as the Canadian dollar continues to grind sideways against the greenback. Going forward, will have to pay attention to the oil markets which look somewhat important, but there has been a bit of the divergence between the Canadian dollar and the Light Sweet Crude markets as of late, something that’s fairly new. Perhaps it has something to do with the fact that the United States is becoming more energy independent, and we may see this correlation break down long-term given enough time.

Ultimately, I see that we are still within a larger consolidation area, and we need to get above the 1.1060 handle in order to start buying with any type of confidence at all. The other scenario where I would be comfortable buying would be on a supportive candle somewhere near the 1.09 handle, but at this moment time I think for to simply going to go sideways.

Interconnected economies.

These 2 economies are very much interconnected, so it’s not uncommon for them to grind sideways. After all, Canada since 85% of its exports into the United States, so with that it’s quite common for these 2 currencies the grind sideways against each other. We are getting closer to the bottom of larger consolidation area, so I do feel that buying is probably what’s about to happen. The be surprised though if we go sideways for a long time before actually having that happen, so with that it’s a bit of a dead market at the moment.

If we do break down below the 1.09 handle, things could get interesting as we could fall as low as 1.06 without too many issues. Because of this, the market is essentially a “buy only” market at the moment, but ultimately will more than likely move in slow-motion and not be as interesting as it could.