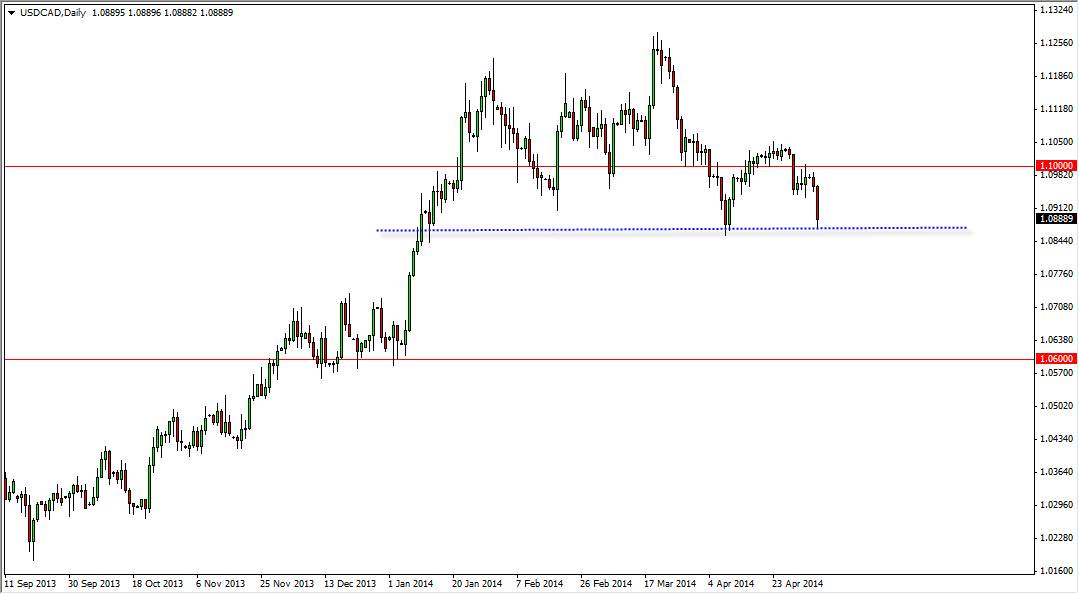

The USD/CAD pair fell pretty hard during the session on Tuesday, testing the very lower levels of the consolidation area that we have been in for some time. This market now looks like it’s ready to break down of it, and we can get below the low that was made in early March, I believe that we will more than likely head down to the 1.07 level, and possibly as low as 1.06 handle. With that, I think that a short-term selling opportunity may present itself, but ultimately I have to question whether or not the market can break down below the 1.06 handle. This will come down to timing more than anything else, but it does look like we will more than likely see a lot of buying pressure sooner or later. After all, the market made a significant bottom several months back, and I don’t know that that’s changed.

Watch the oil markets.

Once the oil markets as per usual as the Canadian dollar is definitely influenced by trends in the energy markets to begin with. With the situation in the Crimea however, could have a little bit of a backwards effect in sense that it might drive up oil prices while driving up the value of the US dollar as well, as traders look for some type of “safety.” I don’t think that anything would be more than a short-term move in that sense, but at the end of the day it’s a possibility.

We are at a perfect spot to see some type a supportive candle however, and I would be all over it. That supportive candle would drive the market back towards the 1.1060 level, and a breakout above there would have is looking for the 1.1250 level. That of course would be a move that would take a lot of chopping and grinding, but it could ultimately happen given enough time. In the meantime though, I am watching the next 24 hours to make the decision as to which direction to go.