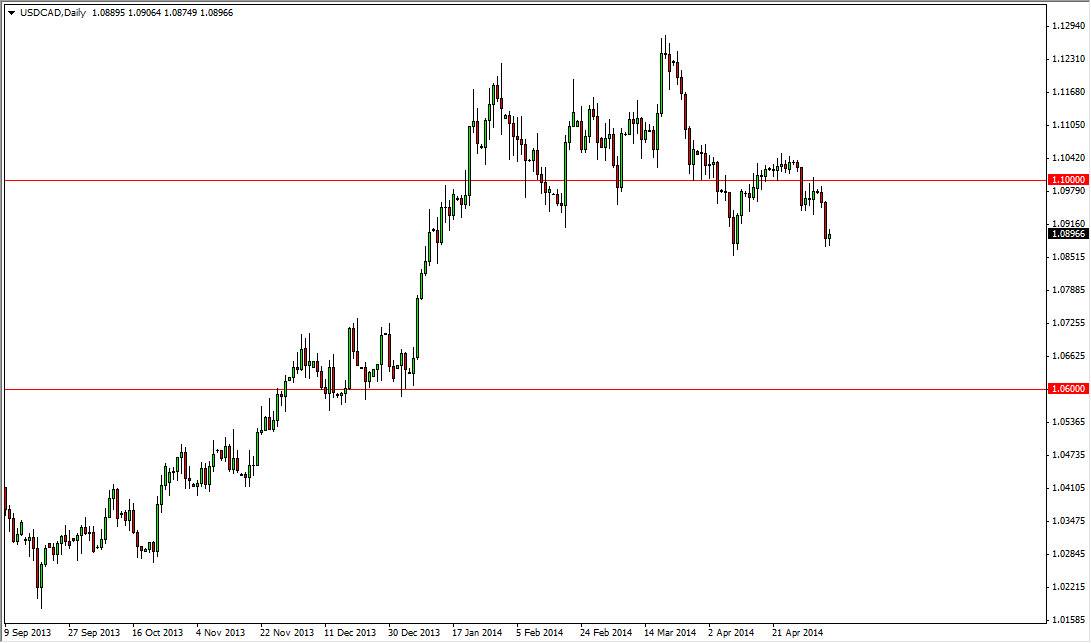

The USD/CAD pair did very little during the session on Wednesday, as we continue to hover just above major support. When you look at this chart, you can see that the 108.80 level has been supportive a couple of times in the past, and as a result we are testing the very bottom of the larger consolidation area. I won’t lie, this market looks very broken at the moment. However, the fact that we did in fact respect that support level during the session on Wednesday and didn’t make any serious attempt to break down leads me to believe that perhaps the buyers may make it stand here.

A supportive candle in this general vicinity is reason enough for me to buy, and I believe at that point the market could very possibly go back to the 1.1060 level. A break above there since this market looking for the 1.1250 level, but let’s I get ahead of ourselves as it does look like the market is weakening overall.

We have to ask whether or not this is the real thing?

I have to ask whether or not this is the real thing if we do get a bounce. After all, this could simply be some type of short-term bounce off of support as the most recent attempt to rally from here failed pre-significantly. On the other hand, if we break above the aforementioned 1.1060 handle, that is a very bullish sign as it would show that not only did we bounce from support, but we picked up enough momentum to make a “higher high.” This is especially significant after making a “lower high.” In other words, the market would be changing his mind again.

This pair does tend to go sideways for great lengths of time, so would be surprising to see a bounce from here. The fact that we really couldn’t do anything on Wednesday leads me to believe that that probably will happen, but I’m very hesitant to get overly excited about a long position at this point as I can see where this could simply be a pop of about 100 pips.