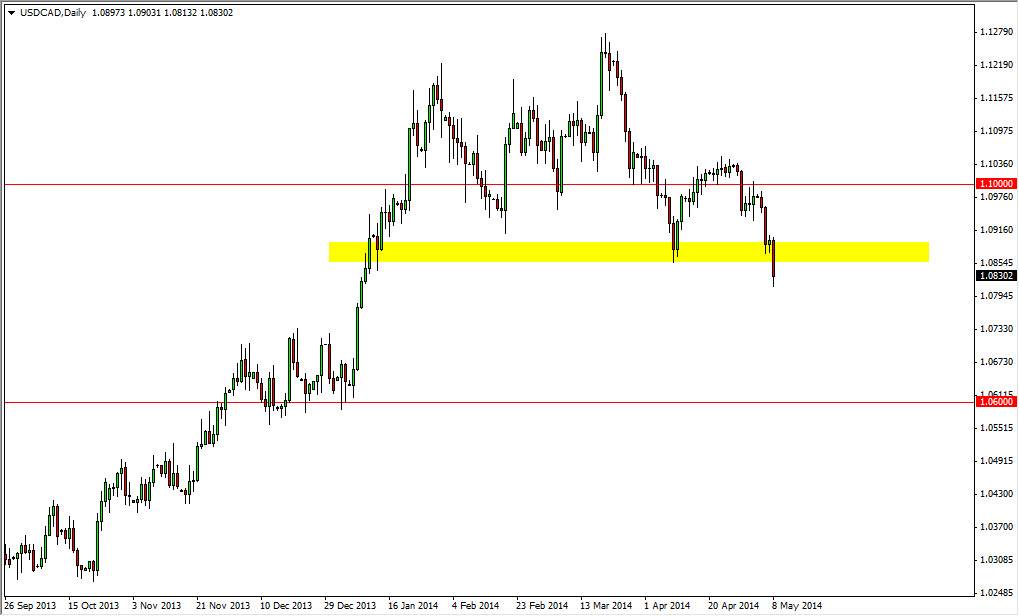

The USD/CAD pair fell hard during the session on Thursday, breaking below the 1.0850 level, and more importantly making a fresh, new low. This of course is very bearish, and now I have to suggest that perhaps this market is going to find itself falling now. This breakdown should of course go looking for support, as is commonly the way. The 1.07 level below is the beginning of significant support all the way down to the 1.06 handle, so therefore it’s very likely that we will at least try to get to the 1.07 handle, and it is very possible that we will go lower than that.

The real question of course is whether or not we can get below the 1.06 handle, which is something that I doubt. The only reason I say this is that the economic conditions in the United States are a bit week, but the Federal Reserve is still tapering off of the quantitative easing program. This should cause interest rates to rise over time, and as a result I think ultimately this is a pullback that will offer a buying opportunity later. However, that’s not to say that we can sell in the short term. A break of the lows from the Thursday session provides a nice short-term opportunity to the downside.

Oil markets and Russia.

Well markets of course will have an effect on the Canadian dollar longer-term, as it typically does. However, I recognize that the situation in the Ukraine will certainly cause oil markets to go back and forth given enough time, as the headlines continue to come out of that region that will of course move the markets back and forth as a line of traders will continue to be somewhat skittish.

However, technically I see the 1.06 level as being far too supportive at this point time to be overly concerned. So in short, I believe you could sell this market on a break of the lows from the session on Thursday, but ultimately turn things back around and start buying on a supportive candle at lower levels.