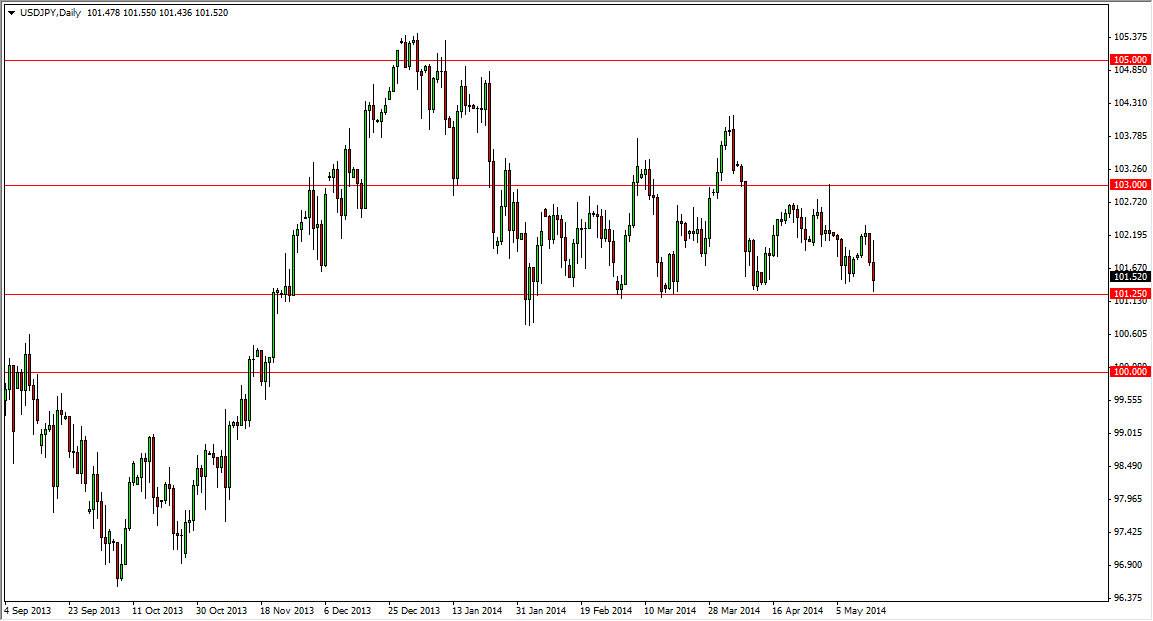

The USD/JPY pair had a pretty wild session on Thursday, as you can see it initially rose to the 102 region. However, we pull back and fell all the way down to the 101.25 level, where we found support enough to bounce slightly. Ultimately though, we have formed a fairly negative candle, and as a result we feel that the market may retest the 101.25 level as support. Short-term charts will probably have to be referenced in order to find and entry into this marketplace, but you cannot forget the daily chart as it shows such a significant and obvious consolidation area overall.

The 101.25 level is significant in the sense that if we break down below that area on a daily close, it’s very likely that we could test the 100 level given enough time. On the other hand, if we get a supportive candle, it’s really not a real stretch of the imagination to go long and hold onto the trade until we get to the 102.50 handle.

Interest rate differential.

The interest rate differential will continue to drive this pair as it typically does, based upon the 10 year notes from both countries. The US should see rising rates given enough time, and as a result we feel that this market will start to pick up again. Nonetheless, we are at an area that has been tested several times, so that there is such thing as a “no-brainer” type of trade, it is going to be found at this level. It doesn’t really matter though, because ultimately we should see this market go higher in general

If we do fall from here, we would more than likely fall down to the 100 level where we should see quite a bit of support. Either way, I am in “buy only mode.” On the other hand, if we get above the 103 level, I feel that the 104 level will be targeted, followed by the 105 level. I do think that ultimately happens, but it’s probably going to take some time.