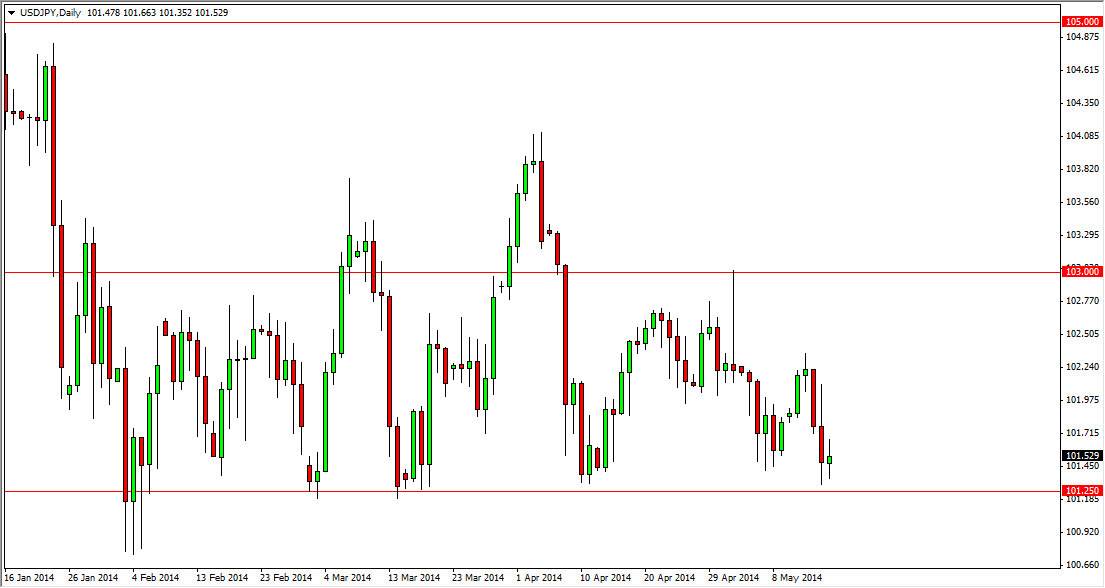

The USD/JPY pair went back and forth on Friday, essentially printing a neutral candle. We still see the 101.25 level as a significant support level as noted on this chart, but at the end of the day I think that ultimately this could be the market trying to form some type of a “floor” in the pair. Even if we broke down from here, I think there is a significant amount of support down to the 100 level as well, so quite frankly I have no intentions of shorting this market at the moment.

This could lead to a nice bounce, possibly as high as 103 at this point. The markets been consolidating since the end of January, and I don’t see why that’s going to end anytime soon. In fact, it is possible that were carving out a range that the market will respect for the quiet summer months.

Interest rate differential?

I won’t bore you with the semantics, but it appears that quantitative easing is not making interest rates in the United States rise with any sense of urgency. That is part of what’s hurting the long side of this trade, as all things even being equal this should be a driver for a higher USD/JPY exchange-rate. With that in mind, I think that it’s only a matter of time before that comes into play, but right now it just doesn’t seem to be working. It’ll be interesting to see how the market deals with this, but I think at the end of the day things will go back to the longer-term correlation of interest rate differentials and the USD/JPY pair.

With that being said, it’s probably more about the bond markets now than anything else in this markets. The markets would appear to be in a grinding stance at the moment, and because of this I think that the sideways action should continue. With this, we could look at this as a “buy only” market at the moment. The pair isn’t exactly exciting at the moment, but sometimes that is a good thing.