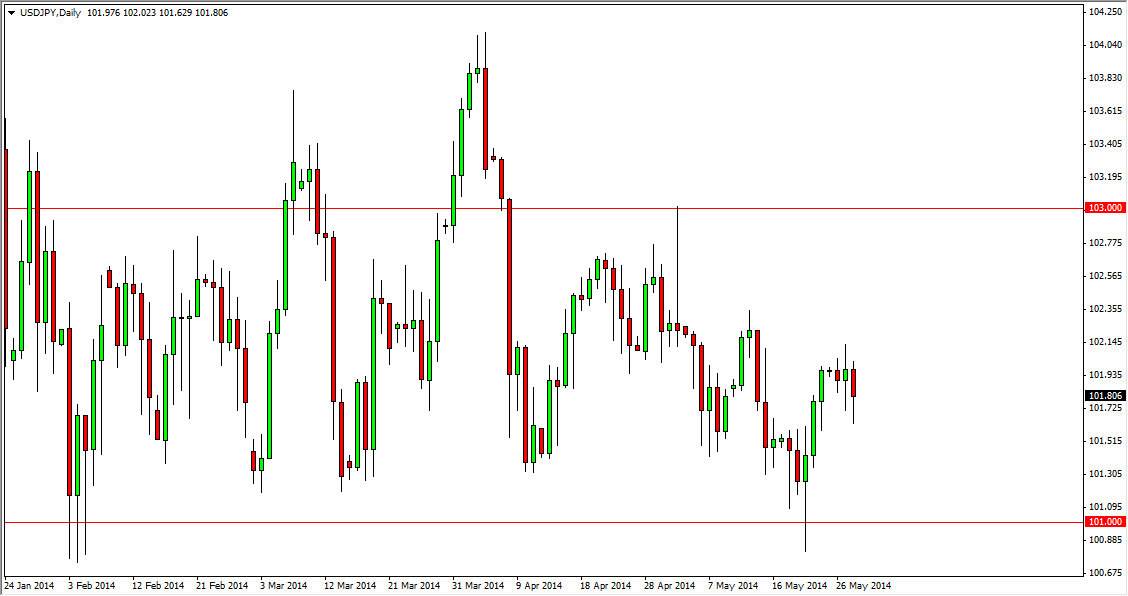

The USD/JPY pair fell during most of the session on Wednesday, but as you can see bounced a bit towards the end of the day in order to form a hammer like candle. This is the 2nd hammer in a row on the daily chart, so therefore I believe that we are forming pressure to breakout to the upside, which I see being held in place by the 102 handle. A move above there, and I believe that we got to the 103 level first. Ultimately, we should go above there as well, and go looking for the 104 level.

Pullbacks at this point time should find plenty of support, after all that’s been the case or some time. I still believe that the 101 level is essentially the “floor” in this particular currency pair at the moment, thereby giving us opportunities to take advantage of value when we drop towards that area.

Interest rate differential should eventually come into play.

The interest rate differential between the 2 currencies and more importantly the bond markets should continue to expand in favor the United States given enough time. With that, I believe that fundamentally this pair should be going higher but I also recognize that there is a certain amount of unease around the world’s markets which continues to throw money into the US bond market. That of course will bring you yields down, and that artificially suppresses the value of this currency pair.

I think at this point in time, this is one of those markets that is looking to form a range for the summer, and I believe that range will be between the 101 and 103 level. On the high side, we could go to the 104 level at best. Ultimately though, I think we will breakout and head much higher than, even as high as 110 sometime between now and the end of the year in my opinion. This will probably have something to do with monetary policy coming out of the Bank of Japan, which is almost undoubtedly coming soon.