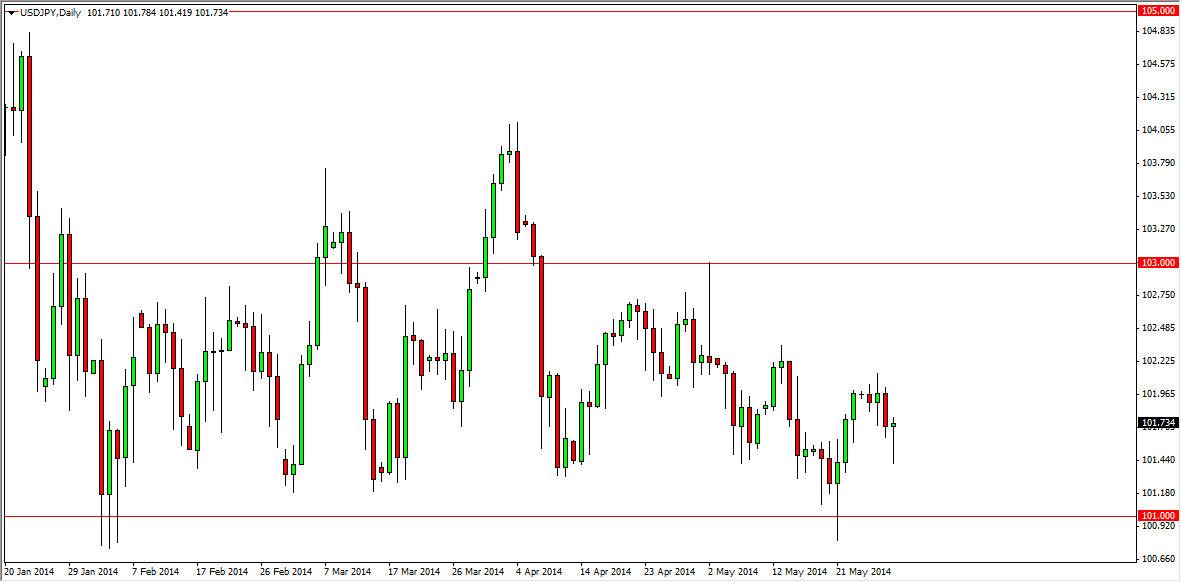

The USD/JPY pair fell initially during the session on Thursday, but as you can see found enough support below in order to push the market back up and form a nice-looking hammer. In fact, this is essentially a perfect hammer. Because of this, I have taken notice and I believe that the market will start to go higher again. The market is essentially in a larger consolidation area, with the 101 level being the bottom and the 103 level being the top. Because of this, I think that a move above the top of the hammer should send this market looking for the 103 level, but there’s probably a bit of choppiness between here and there. It doesn’t matter though, I believe that the summer is probably going to see very sideways action in this market.

Ultimately, I am bullish.

Ultimately, I am bullish of this market as I believe that the interest rate differential between the United States and Japan will continue to expand over time. There is money flowing into the bond markets though, so that of course is keeping the yield down in the United States, but as soon as that stops there is a strong inclination that this market should continue to go higher as the Bank of Japan is almost dead set in order to start easing its monetary policy yet again. I should disclose this though, I am already short of the Japanese yen but not against the US dollar. I prefer shorting the Yen against currencies that offer some type of higher yield, such as the Turkish lira.

However, I think that we are forming a nice base now, and that the market will ultimately go much higher. This is a longer-term call of course, but in the meantime there’s quite a bit of money they can be made by going long of this market every time we dip as we just have. Adding to that the fact that we have formed a very supportive candle and you have a very reasonable and responsible position to take to the upside.