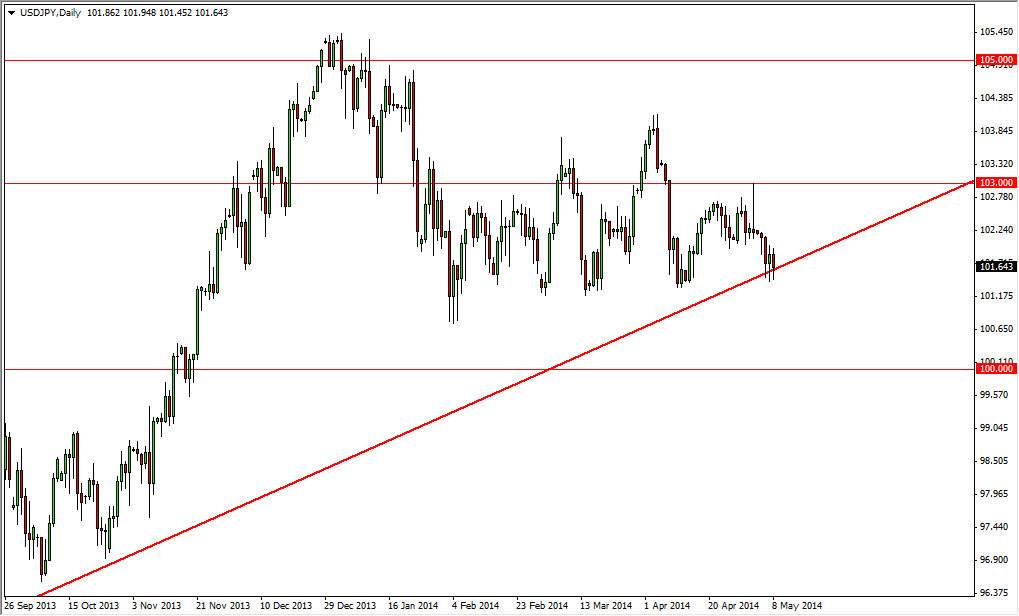

The USD/JPY pair fell during the session on Thursday, but found the 101.50 level to be supportive yet again. This is an area that has been supportive time and time again, but at the end of the day we recognize that the candle close towards the bottom of the range. Because of this, there is the possibility that sellers will continue, but I am more apt to be a buyer down here, simply because the area has acted as such good and reliable support, plus we have the uptrend line that the market is testing at the moment, so there is a real opportunity for this market to go higher from here. However, we are going to need to see some type of supportive candle in order to feel comfortable buying.

The truth of the matter is that the market has been fairly range bound recently, and at the end of the day I think that this market could pop back to the 102.50 level, but ultimately the 103 level is the significant resistance the needs to be overcome. I think it’ll happen, but it might take quite some time. Obviously, the market seems to be relatively comfortable in this general vicinity, so the move higher could take some time going forward.

I don’t like the Japanese yen in general.

The truth is that the US dollar is struggling against the rest of the market more than the Japanese yen is doing so well. For example, I am long the TRY/JPY pair, a market that has done quite well recently. The fact is that there isn’t enough of a positive swap in the marketplace yet for this pair to go much higher. Ultimately, I think that is going to change given enough time, but the Federal Reserve has just now started to peel back quantitative easing. The quantitative easing been pullback will naturally bring interest rates up in the bond markets given enough time, and that should favor the US dollar overall as the Japanese bonds are still being purchased by the Bank of Japan.