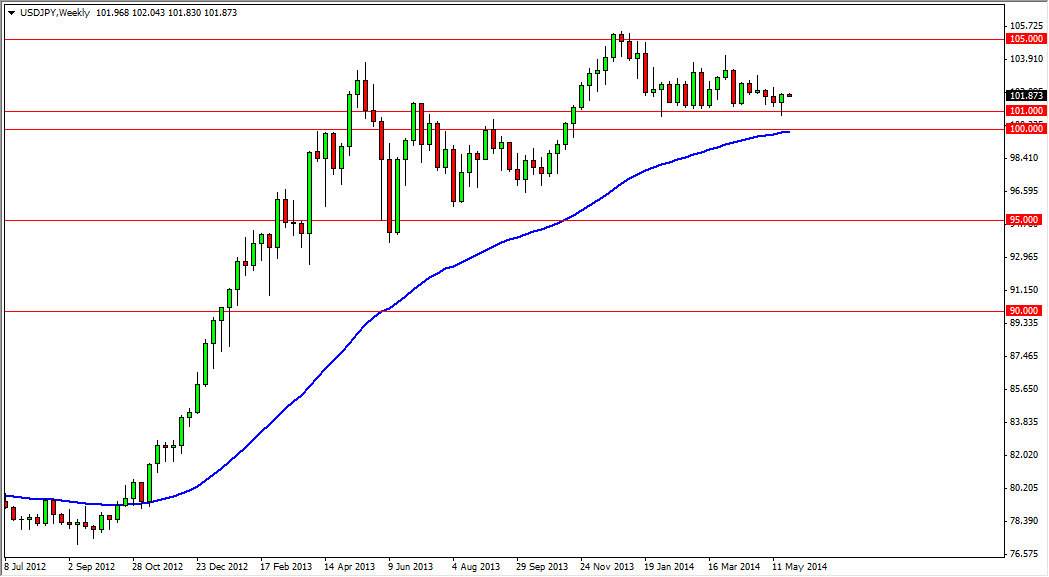

The USD/JPY pair has been stuck in a relatively tight consolidation range for some time now. Because of this, I feel that this market is trying to build up a little bit of momentum before going higher, and the fact that we are heading into the summer time does not lend well for massive moves as far as I can tell. However, I do recognize that there is most certainly an upward tilt to this market, and on the weekly chart that I’ve attached to this article, you can see that the 52 week moving average, courses a year, is definitely looking positive, although we are starting to slow down the angle of assent.

With that, I believe that we will continue to have fairly choppy conditions with a fairly tight range, thereby making this the type of market that short-term traders will probably prefer over the next month. Regardless though, I have no interest whatsoever in selling this market.

Big support level

I think that there is a pretty big support level just below, at the 101 level. I also believe that the 101 level support area extends all the way down to the 100 handle, which means city should be rather significant. I will be playing this market only to the upside, but I don’t expect massive gains. Ultimately, I would expect the 105 level to be hit though, and that is my first target as far as long-term trades are concerned.

I am short of the Japanese yen against several other currencies, with the most notable being the Turkish lira. I believe that the Japanese yen will continue to depreciate overall, but this pair is a little bit different in the sense of the United States has extraordinarily low interest rates at the moment. Because of this, there is no swap to be had and I believe that’s one of the few things keeping this market down. Ultimately though, I believe that once we get back to higher volume trading in the fall, this pair should continue its march higher. In the short term, I believe that the month should offer plenty of buying opportunities, albeit on short-term charts.