USD/JPY Signal Update

Yesterday’s signal expired without being triggered at 100.88 was not hit before the Bank of Japan’s Monetary Policy Statement was released.

Today’s USD/JPY Signals

Risk 0.75%

Entry may be made only between the London open and New York close, and during the upcoming Tokyo session.

Long Trade 1

Go long if the hourly candle closing at 9am London time is a strong pin bar rejecting 100.75 and closing above that level.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 101.18 and remove 50% of the position as profit.

Close half of the remainder of the position as profit at 101.65 and then close the entire position at 102.00.

Short Trade 1

Short entry at the first touch of 101.66.

Put a stop loss at 102.10.

Move the stop loss to break even when the price reaches 101.35 and take 25% of the position as profit.

Leave the remainder of the position to run.

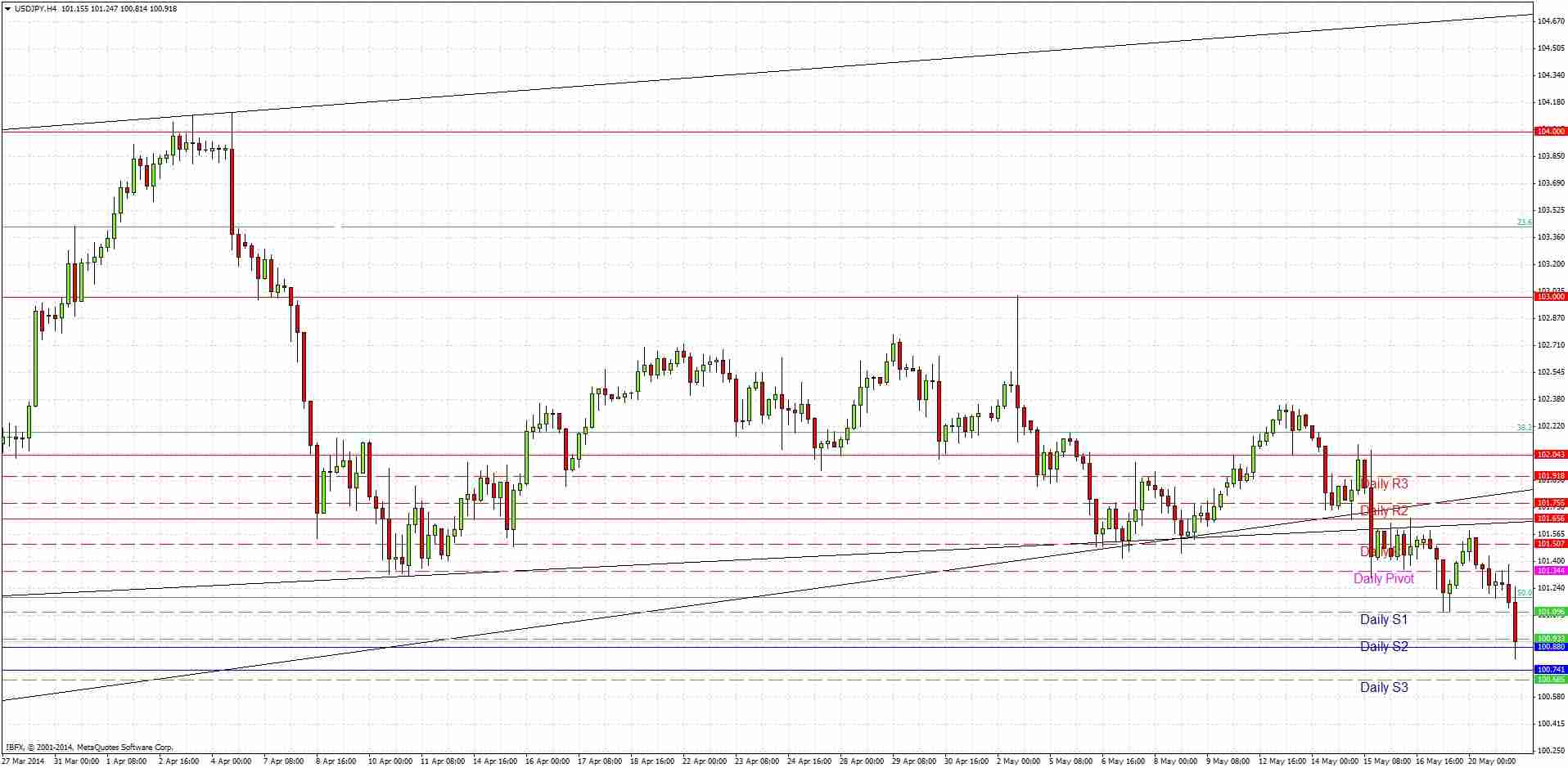

USD/JPY Analysis

The JPY continued to look strong yesterday and has just a few minutes ago strengthened further with the release of the Bank of Japan’s Monetary Policy Statement. The JPY is now making new highs against most currencies and is currently the strongest global currency in the Forex market.

I would look for a conservative long if we get a fast bounce off the support at 100.75 right away, otherwise I would not be looking for any longs today.

Given the JPY strength, an interesting scenario might be if the FOMC statement later today causes a strong spike up in the USD. This just might push the pair to key resistance at 101.66 which would probably be an excellent short touch trade, although this is probably unlikely to happen.

We are sitting in a zone from 100.88 that may extend all the way down to 100.50 that has over the recent move been very supportive.

There are no high-impact news releases due today concerning the JPY. Later at 7pm London time, the FOMC statement will be released, which is likely to affect the USD.