USD/JPY Signal Update

Last Thursday’s signal was not triggered and expired. The open short trade we had closed at break even.

Today’s USD/JPY Signals

Risk 0.75%

Entry may be made only between the London open and New York close, and during the upcoming Tokyo session.

Long Trade 1

Go long after confirming bullish price action on the H1 chart following the first touch of 100.88.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 101.45.

Remove 50% of the position as profit at 101.45 and leave the remainder of the position to run.

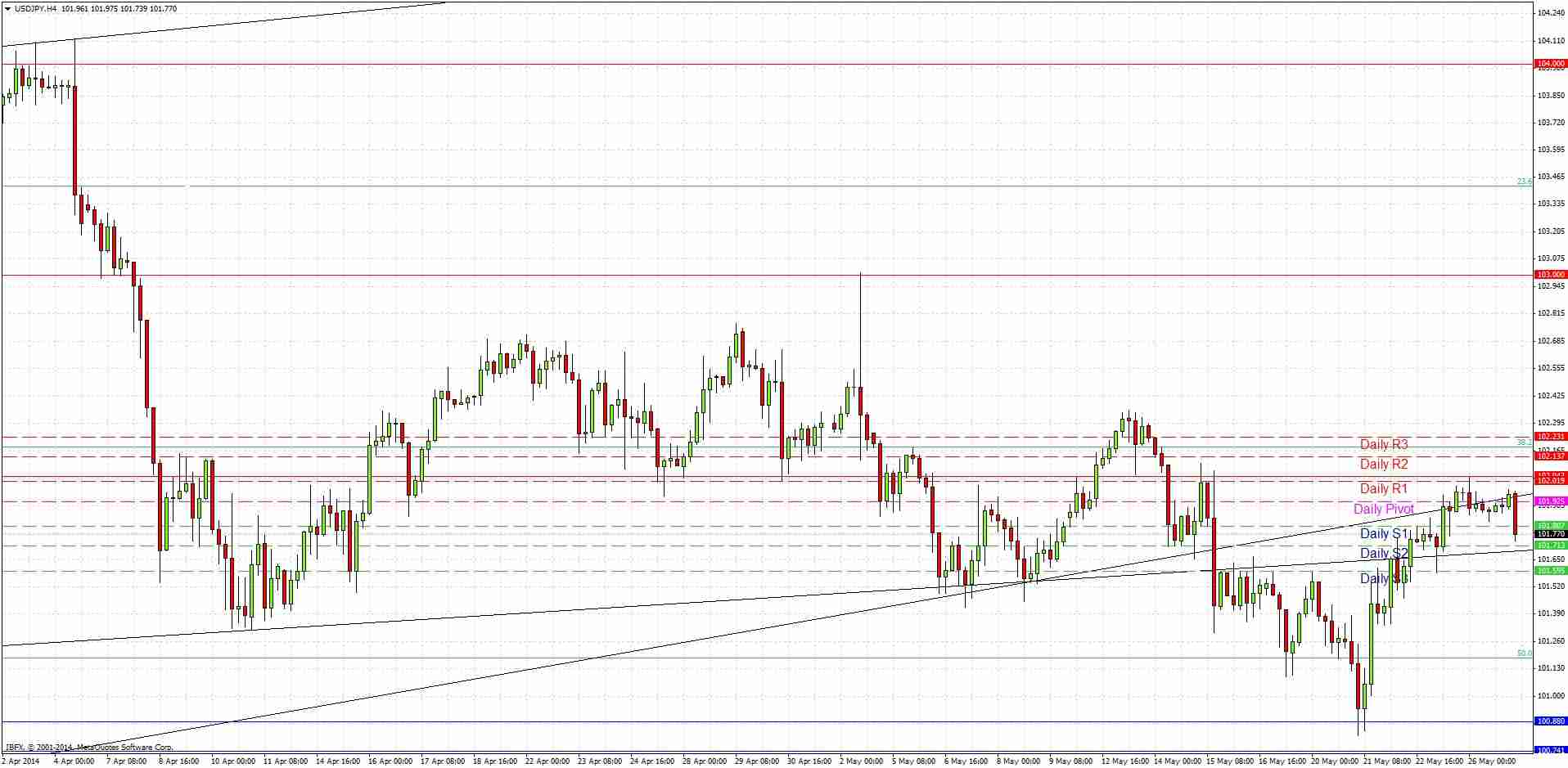

USD/JPY Analysis

The move up from last week’s support zone at around 100.88 continued for the remainder of last week, with the price only really falling again once we touched the resistance at 102.04.

The trend lines have now been abused enough that they are not trustworthy guides as to how the price is likely to move now going forwards.

I am not looking to short at another test of 102.04 as it is too weak a level and has been touched very recently.

This pair’s action looks uncertain and unpredictable over the next day or so, although a return to the support at around 100.88 should be interesting for another long.

We can expect a lively start to the next Tokyo session as the Governor of the Bank of Japan will be speaking at around the opening time.

The Governor of the Bank of Japan will be speaking at 1am London time, which is likely to produce some volatility. Earlier, concerning the USD, there is the CB Consumer Confidence data at 3pm London time.