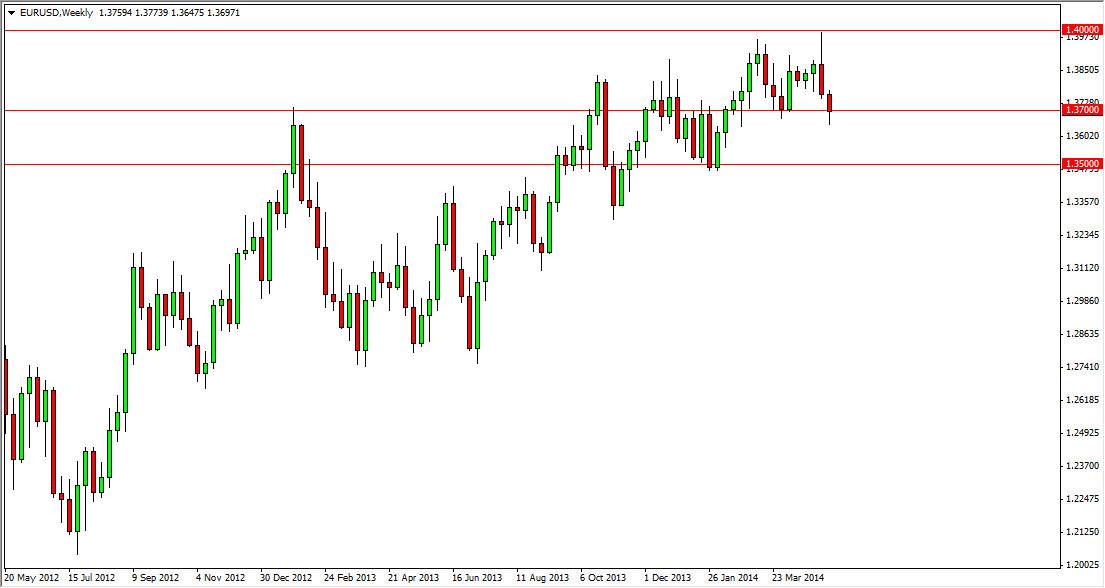

EUR/USD

The EUR/USD pair continues to see weakness, but the vital 1.37 level held on Friday. With this in mind, I think that the market might find buyers at this point, and as a result we could see a bit of sideways action. The pair also could fall – but I think that that fall is limited to the 1.35 level at best. The markets will continue to be more of a short-term affair in my opinion.

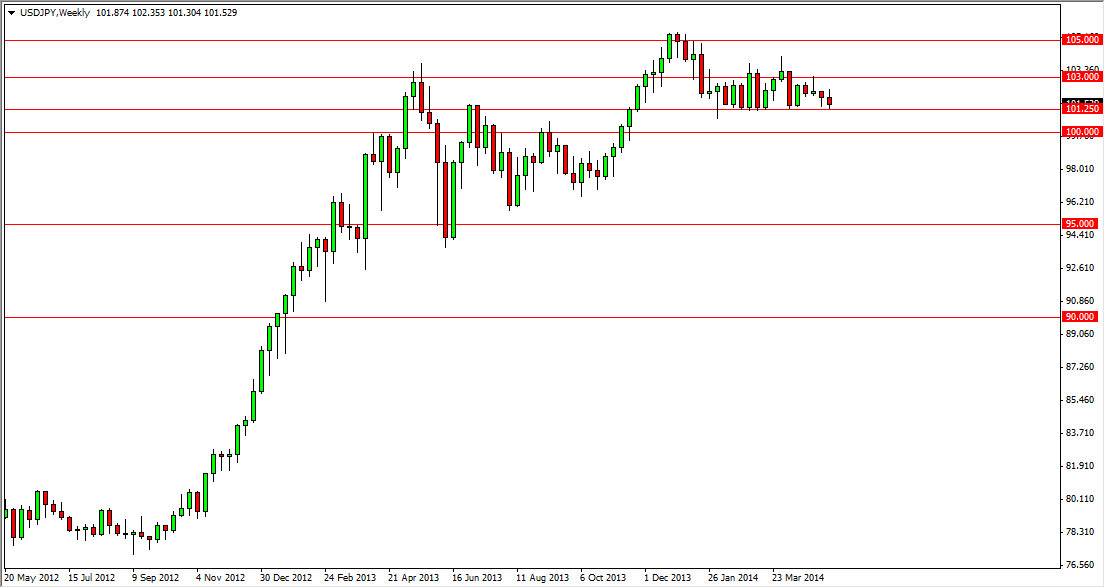

USD/JPY

The USD/JPY pair found itself slightly bearish over the week, but as you can see we have just been grinding sideways for some time now. I think that this pair could put a lot of traders to sleep – which often means that an explosive move is coming. At this point, I would have to assume it is to the upside given the move over the last year and a half or so.

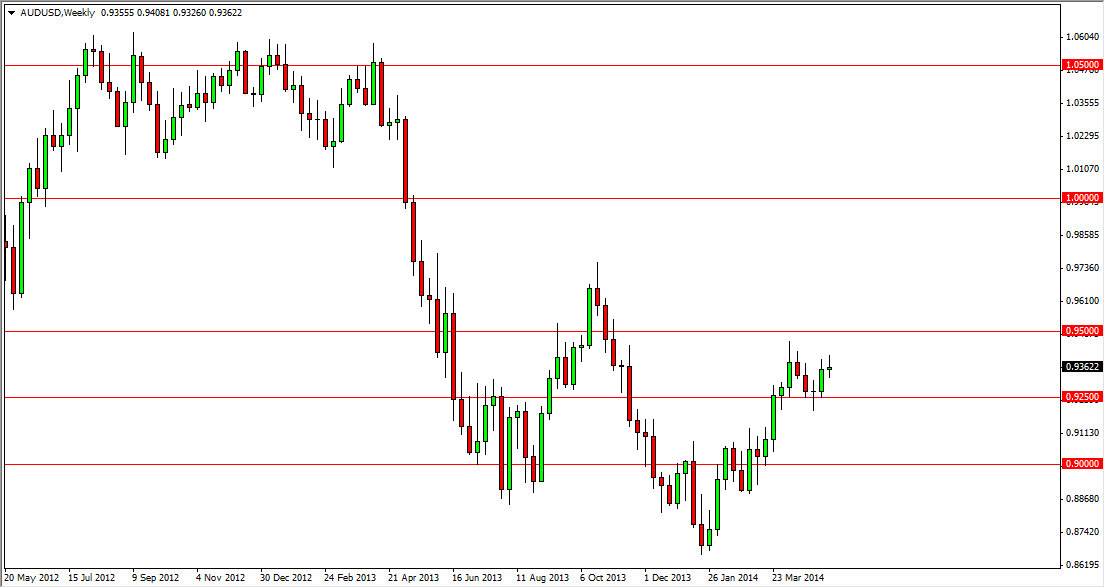

AUD/USD

At the moment, the pair looks likely to take a bit of a break, but I believe that the real test is to be found at the 0.95 level, and getting above there is a massively bullish sign. I would be a long-term buy-and-hold guy at that point, and think it could be coming. However, this is going to take some time, and as a result I think that this pair will be kind of slow in the next couple of weeks. Watch the gold markets as per usual. The correlation has been a bit soft lately, but in the end the market will return to that correlation, and when it does – this should be an easy trade of sorts.

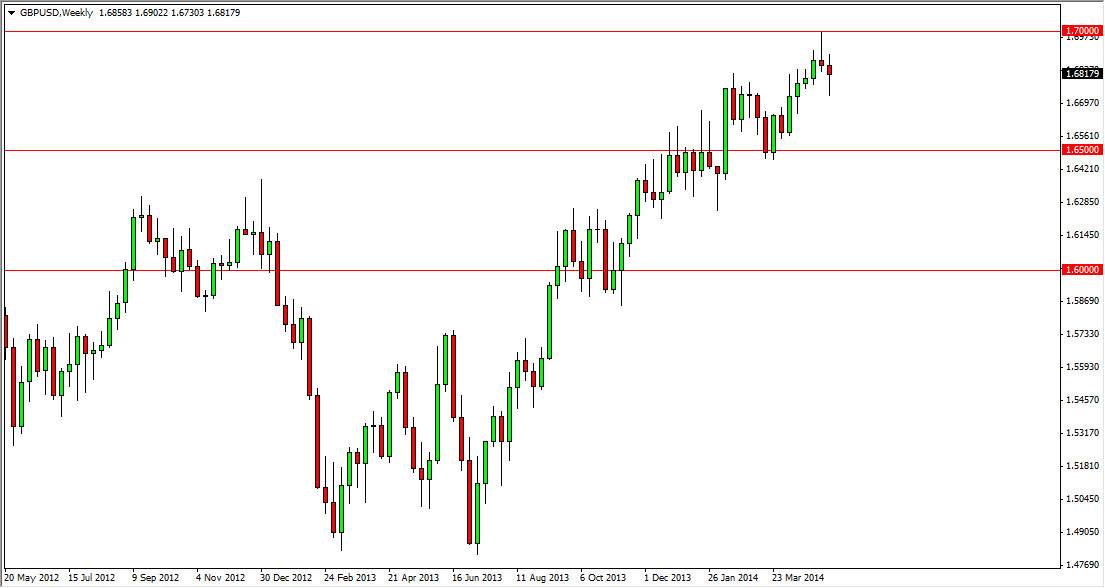

GBP/USD

The GBP/USD pair spent most of the time falling during the previous week, but found enough support to cause a hammer to form. This hammer suggests that the market is going to try to break above the 1.70 level again – something that I figure to be true. The market needs to break above there on the daily close first though in my opinion. If it does, I think we go to the 1.75 level. On the other hand, we could pullback from here and test the 1.65 level, an area that I consider to be the “floor” in this market currently. Either way, I am not selling this pair.